What is an OTP number?

A one-time password (OTP) is a unique, time-sensitive code sent to verify user identity during online transactions or logins. Acting as an extra layer of security, OTPs ensure that only authorised individuals can proceed with sensitive actions like account access or purchases. These codes are valid for a limited time and provide strong protection against unauthorised access, even if your primary password is compromised.

It’s essential to keep your OTP private, as sharing it with others can expose your account to fraud. Remember, no legitimate bank or service provider will ever ask for your OTP, so keep it confidential to protect your sensitive information.

When is an OTP generated?

An OTP is generated whenever an action requires additional security. Typical instances include online purchases, logging in from a new device, or changing account settings. For example, if you’re making an online payment, the OTP is sent right after you input your card details, allowing you to securely complete the purchase.

Benefits of OTP

- Enhanced security: Since an OTP can only be used once, it reduces the risk of fraud or unauthorised access.

- Temporary validity: The OTP expires after a short duration, making it useless to potential hackers after its intended use.

- Simple and convenient: OTPs are easy to use, and you don't need to memorise them. They are generated and sent instantly, allowing quick verification.

- Multi-device compatibility: OTPs can be sent to your mobile device, email or authentication app, making it accessible no matter where you are.

How does an OTP work?

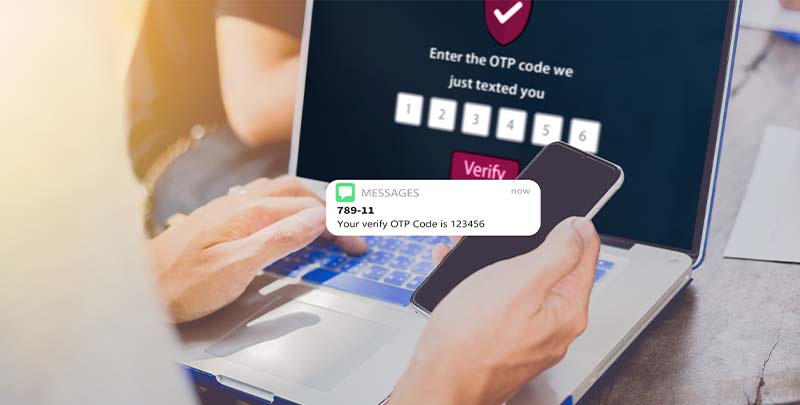

Understanding how an OTP works is essential to appreciating its security benefits. When you trigger an action, such as logging in or completing a payment, the system generates a unique OTP code. The code is usually a random set of numbers sent via SMS, email, or an app. You should enter this code within the given time limit to verify your identity.

What is OTP in Debit Card transactions?

In an online Debit Card transaction, an OTP secures your purchase by adding a layer of verification. After entering your card details, a unique OTP is sent to your registered mobile number, which you must input to authorise the payment. This ensures that even if someone has your card information, they cannot complete a transaction without the OTP, providing strong protection for your account and funds.

What is OTP in Credit Card transactions?

In Credit Card transactions, an OTP serves as a security measure to confirm the cardholder’s authorisation. After entering your card details, an OTP is sent to your registered mobile number, which you must enter to complete the purchase. This extra step prevents fraud, ensuring that even if your card details are compromised, a transaction cannot proceed without the OTP, enhancing your financial security.

Also Read: How to do a wire transfer in 6 simple steps?

Conclusion

An OTP is a powerful tool for securing online transactions and logins, providing protection against fraud and unauthorised access. Whether you're using a Debit or Credit Card, OTPs add an extra layer of verification, ensuring that only you can complete each transaction.

With Axis Bank's Secure+ Debit Card, you can enjoy higher transaction limits and the convenience of contactless payments while benefiting from the enhanced security of OTP verification.

Disclaimer: This article is for information purpose only. The views expressed in this article are personal and do not necessarily constitute the views of Axis Bank Ltd. and its employees. Axis Bank Ltd. and/or the author shall not be responsible for any direct / indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information. Please consult your financial advisor before making any financial decision.