When travelling abroad–––whether for leisure or business how to carry wads of foreign currency is a question that’s on everybody’s mind.

After all, you are concerned about the safety of your hard-earned money, particularly in foreign land, right?

You want to spend quality time for leisure activity or business.

While Travellers Cheques are a regular alternative, a much safer, and convenient option to use are Forex Cards.

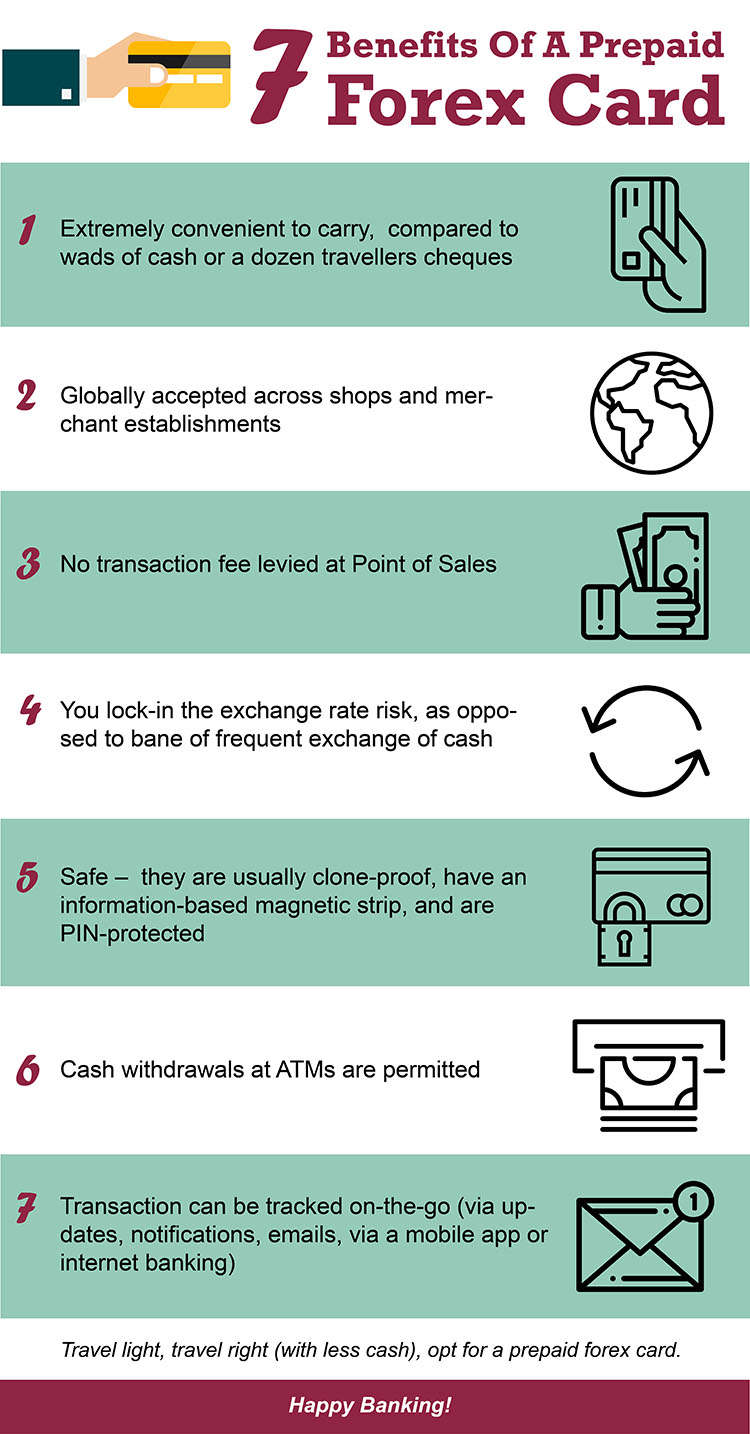

The 6 benefits of opting for a prepaid Forex Card are:

- Extremely convenient

- It is extremely convenient to carry a prepaid Forex Card compared to wads of foreign currency or a dozen travellers cheques. If you are travelling across continents or countries, opting for a prepaid a Forex Card that facilitates loading

money in multiple currencies is particularly useful. A prepaid Forex Card is globally accepted across shops and merchant establishments. Even transport services abroad, accept it.

- Helps you save

- With a locked-in exchange rate, when you load money on a prepaid Forex Card, the cross-currency fluctuation spreads, the bane of frequently physically exchanging money abroad, is avoided. Additionally, there are no conversion fees

or surcharges as in the case of credit and

debit cards. This avoidance of outflow, results is savings for you.

- Safe

- You do not have to worry about the safety of your hard-earned money, because they are usually clone-proof, use an information-based magnetic strip, and PIN-protected. They enable you to transact securely whether offline or online.

- And in case of any problem, there’s a global emergency assistance service, whereby you can block your card, get emergency cash, get emergency assistance on lost passport, and so on. Moreover, an insurance coverage is offered

on the card.

- No transaction fee

- As opposed to credit and debit cards, there are no transaction fees levied at Point of Sales (POS) on a prepaid Forex Card – and that’s irrespective on the amount spent.

- Cash withdrawals possible

- A prepaid Forex Card has cash and debit rolled into one facilitating you to withdraw cash using the card, subject to the balance available. This is helpful when you are travelling to a remote place and after you return from your international

trip.

- Keep track of your transactions

- Tracking transactions is almost on-the-go with constant updates, notifications, emails, or you may even fetch reports via a mobile app or via

internet banking. This is great to keep a check on expenses.

To conclude…

Travel light, travel right (with less cash), and make a smart choice by opting for a prepaid Forex Card.

No need to look around for an exchange kiosk. Just walk into your bank and approach your relationship to purchase a prepaid Forex Card for your international trip. Note that, it always sensible to buy a Forex Card than buying foreign currency

from the bank and avoid the potential currency fluctuations and hidden charges.

Use the financial options available wisely to your advantage.

Happy Banking!

Disclaimer: This article has been authored by PersonalFN, a Mumbai based Financial Planning and Mutual Fund research firm known for offering unbiased and honest opinion on investing. Axis bank doesn't influence any views of the author in any way. Axis Bank & PersonalFN shall not be responsible for any direct / indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information. Please consult your financial advisor before making any financial decision.