7 MinsJuly 24, 2020

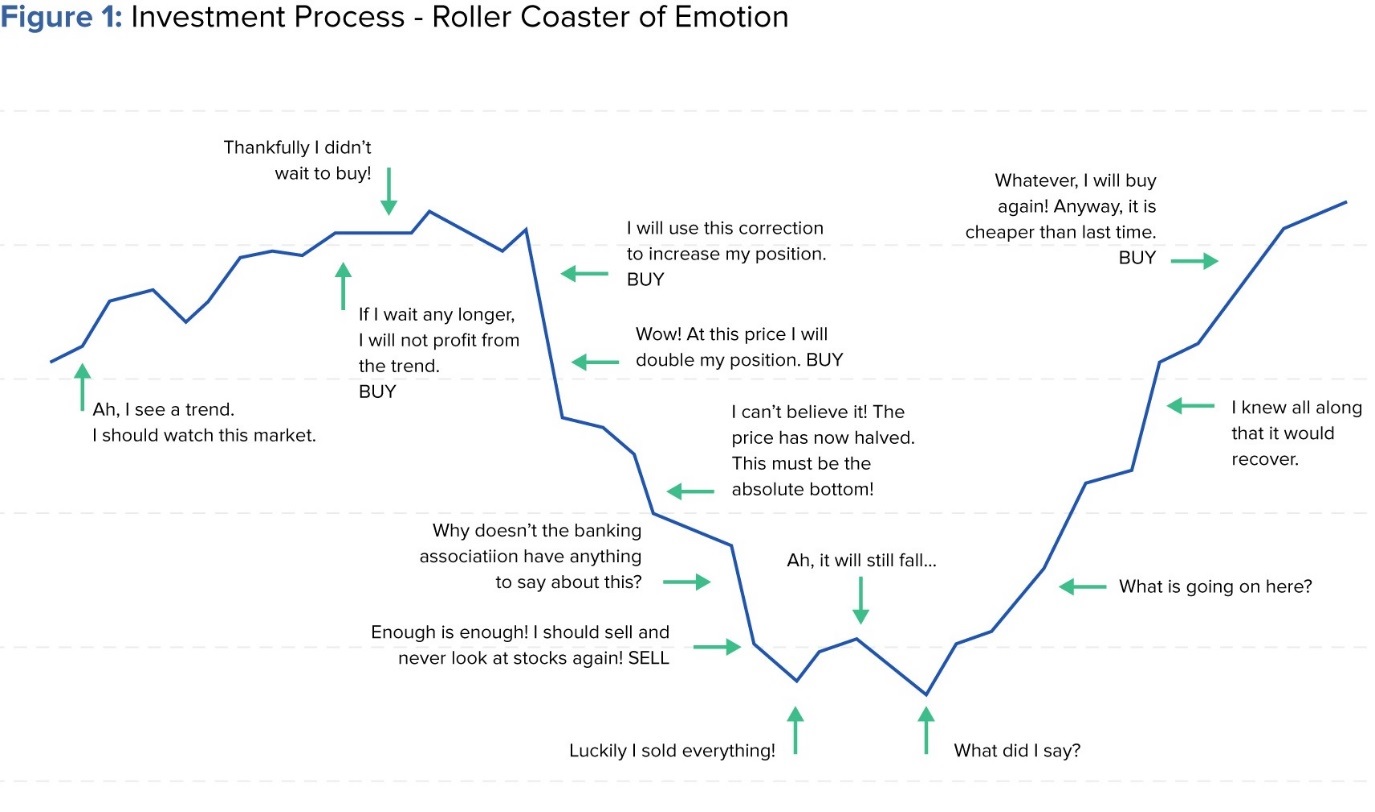

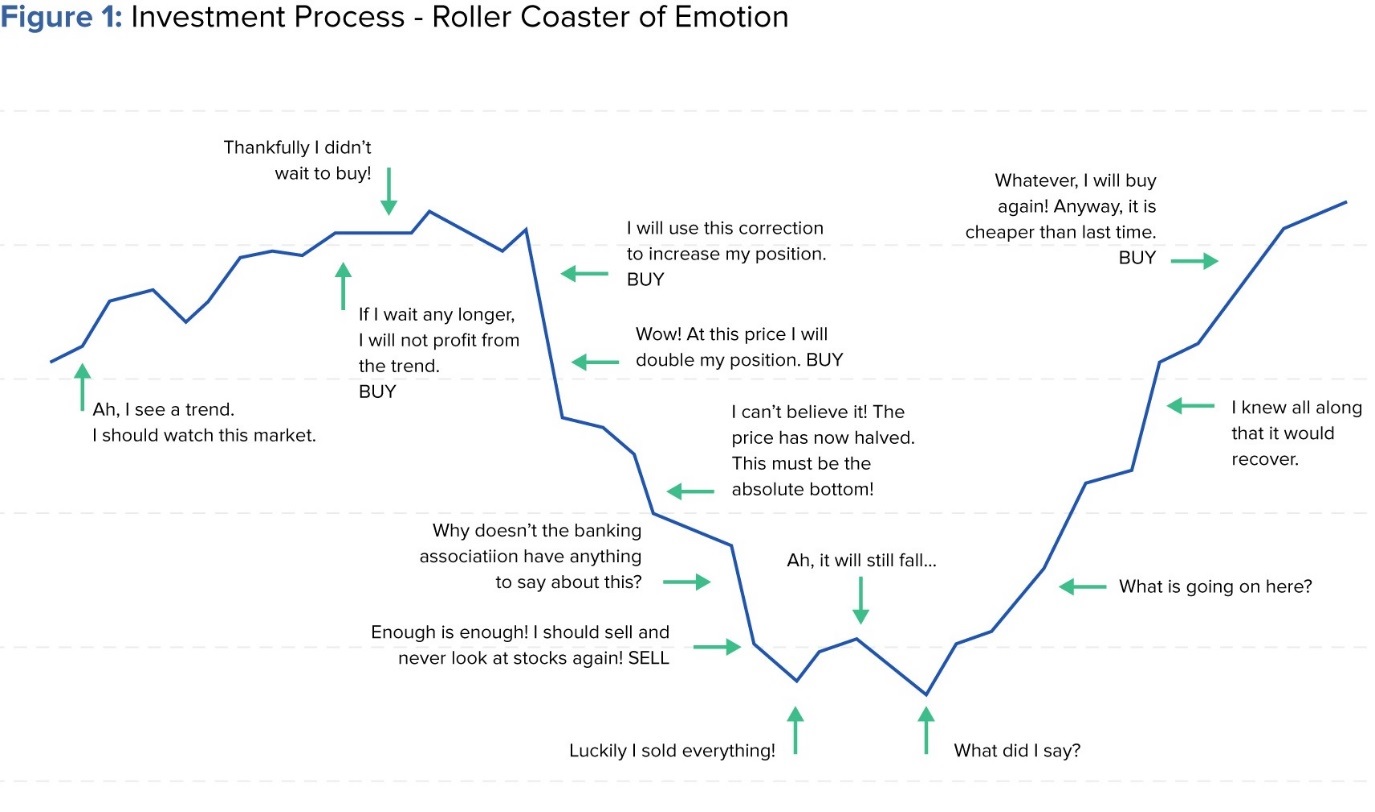

Investment decisions made by investors are subject to a number of biases. A bias is an irrational assumption or belief that warps the ability to make a decision based on facts and evidence. Investing biases can lead people into making financial

decisions for reasons other than those led by factual information, potentially diminishing their long-term financial stability.

An investment process, which includes many steps like data collection, evaluation of various investment options (stock, mutual fund, bonds,etc), buying and selling of those investments

and again following the same steps for a new investment is,in any case, full of psychological pitfalls. However, to make an optimal investment it is important to reach an impartial decision and this will be achieved if one identifies, understands

and hopefully overcomes these biases.

Source: Credit Suisse, https://www.toptal.com, Axis Bank Investment Research

There are basically two approaches to decision-making:

- Reflexive – Going with your gut, which is effortless, automatic and, in fact, is our default option

- Reflective – Logical and methodical, but requires effort to engage in, actively.

Today, a lot of information is freely available to investors which often leads them to taking their own decisions. There are a lot of sources available to upgrade their knowledge on finance which makes them do their own analysis and more often

than not, when investors act upon them,they tend to overlook the data points which may not support their investment decision. Such biases towards one’s investments may hurt the returns and in all probability, punish the long-term wealth

creation process. Below are a few investor biases which most of us can relate to.

Hindsight bias

Hindsight bias occurs when an investor looks back at past events. It is a phenomenon in which investors believe that they accurately predicted an event before it occurred.However they often fail to realize that a lot of information available today

was not available when the event actually happened. It deludes the investor into thinking that future events are more predictable than they really are. Hindsight bias thus has the tendency to lead investors into a false sense of security,

making them take unnecessary risks. This error in prediction leads the investor to bear the risk above their accepted level which is harmful to their wealth. This error in prediction leads the investor to bear the risk above their accepted

level which is harmful to their wealth.

Herd mentality

Herd mentality is a thought process that makes an investor follow a trend or a movement. Lot of investors make investments just because other investors are investing in a particular stock or a sector.This however, may not be a wise move for

an investor who has his own unique set of objectives or financial plan. These decisions are made by just following a large group of people without considering important aspects of investing like valuations, risk factors,the investors’

(who are being ‘followed’) backgrounds and their investment styles and the reasons thereof and so on. It is very important for an investor to know himself and his own psychology, risk tolerance, investment horizon and risk taking

abilities amongst other factors before blindly following a herd. For, isn’t it said that “If everyone is thinking alike, then someone isn’t thinking?”

Chasing Trends

This is arguably the strongest investing bias. A lot of investors invest by simply following past trends. Some myopic investors will look at trends of just the recent past (say last one year) and make their long term investment plans.

Although financial products often include the disclaimer that "past performance is not indicative of future results" investors still believe they can detect patterns and predict the future by studying the recent past. Even if a pattern

is found, it cannot be the sole basis for making an investment decision. Proper and thorough research should always be undertaken before investing in any kind of market linked product.

The table below illustrates the returns generated by different asset classes in different years over the last decade. The table clearly summarises that different asset classes perform in different market cycles and investors cannot

chase a particular asset class by just seeing the past returns.

Table1: Asset Class Returns for the last 11 years.

| Time Period | Equity Returns (%) | Debt Returns (%) | Gold Returns (%) |

|---|

| 2020(YTD) | -25.65 | 4.85 | 21.15 |

| 2019 | 13.80 | 9.50 | 24.30 |

| 2018 | 5.10 | 6.70 | 7.90 |

| 2017 | 28.00 | 6.10 | 13.10 |

| 2016 | 2.00 | 9.80 | 8.60 |

| 2015 | -5.00 | 8.70 | -10.40 |

| 2014 | 29.90 | 10.50 | -1.70 |

| 2013 | 9.00 | 8.30 | -28.00 |

| 2012 | 25.60 | 9.10 | 7.10 |

| 2011 | -24.70 | 7.90 | 10.10 |

| 2010 | 17.40 | 4.70 | 29.50 |

| 2009 | 81.00 | 6.60 | 24.40 |

*Source: MFI Explorer YTD returns till 22nd May 2020

(Equity benchmark- S&P BSE Sensex, Debt benchmark- Crisil Short Term Bond Fund)

[Also Read: Financial planning tips to save for your future]

Loss Aversion

Loss aversion is where investors are so fearful of losses that they focus on trying to avoid a loss more than on making gains.Research on loss aversion shows that investors feel the pain of a loss more than twice

as strongly as they feel the enjoyment of making a profit. Many-a-time, investors do not sell their investments when the loss is small as it is not a loss as long you don’t sell it. Such investors continue to avoid selling the investment

for a long time when their current rational analysis of the stock clearly indicates that it should be abandoned as an investment.

Confirmation Bias

There is generally a tendency of people to pay close attention to information that conforms to their beliefs and ignore information that contradicts it. This type of bias is known as the confirmation bias. Most of us are prone to confirmation

bias. We tend to look for conforming, rather than non-conforming, evidence.

What should investors do?

Many investors, knowingly or unknowingly, may react emotionally while making investment decisions and may possess one or many of the biases stated above. And hence, it is prudent to have a long term investment plan in place and follow a disciplined

investment approach. Below are the points that an investor should keep in mind during his investment journey:

Manage emotions - Studies show that investors feel greater pain from investment losses than satisfaction from investment gains. Investors who were hurt by past financial crisis for example, the technology bubble (2000) or the

great financial crisis (2008) have a justifiably heightened fear of investment losses. Emotions contributed to pain selling at several pivotal moments. Investors who calmly assess the investment implications are more likely to benefit from

the opportunities provided by each event.

Investment Horizon and Risk Appetite - The purpose of investing is not just to earn the highest returns but to help one to predictably and easily achieve the various objectives and goals.For thisto happen,

one needs to always consider investment horizon and risk appetite before making a financial decision.

Time in the market is better than timing the market - Some investors wait for the right time to enter the markets, these may not be the right strategy to invest for long term.Market timing requires investors to find the best time

to sell (at the top) and then again buy when the market is at the bottom. Here you are predicting not once but twice, and only in hindsight does one know the market peak or trough. Waiting for the right time to invest may potentially

reduce your returns as you will waste a lot of time not participating in the market. Hence, it is prudent to invest without waiting for the right time and be a long term investor.

Asset Allocation - Asset allocation helps to determine allocations to different asset classes within your investment portfolio. Asset Allocation helps to diversify your portfolio as it combines different asset classes and hence,

provides your portfolio with both the possibility of growth and potential protection against loss due to the fact that different asset classes perform differently over different time periods.

Timely rebalancing - Rebalancing is about sticking to the long term investment plan and not timing the market. Rebalancing is one way for investors to position themselves to withstand a downturn in the market and participate in

the recovery as well. Extreme market events, a bull or a bear market, may change your asset allocation drastically. And hence, rebalancing your portfolio on a timely basis is an important aspect of asset allocation. To give you a perspective,

even if one were to follow a basic asset allocation of 50% equity and 50% debt in their portfolios, a ~25% correction in equities would mean the portfolio now will be 40% Equity and 60% in Debt. For a long term investor, this deviation from

the asset allocation will have to be rebalanced by buying more equities.

Systematic Investment Plan - Systematic Investment Plan or SIP is an ideal way of investing for long term goals. When investing through the SIP route, one need not worry about timing the market. SIP helps in rupee cost averaging

(it helps you buy more units when markets are low and fetches you less units when markets are high).

Disclaimer: This article is for information purpose only. The views expressed in this article are personal and do not necessarily constitute the views of Axis Bank Ltd. and its employees. Axis Bank Ltd. and/or the author shall not be responsible for any direct / indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information. Please consult your financial advisor before making any financial decision

Mutual Fund investments are subject to market risk, read all scheme related documents carefully. Axis Bank Ltd is acting as an AMFI registered MF Distributor (ARN code: ARN-0019). Purchase of Mutual Funds by Axis Bank’s customer is purely voluntary and not linked to availment of any other facility from the Bank. *T&C apply