6 minsApril 15, 2018

A personal loan can be disbursed within 48 hours, if you satisfy the eligibility criteria, documentation in complete, and maintain a healthy credit score.

Effectively, a personal loan can give you easy access to money when you need it the most!

Who is eligible for a personal loan?

- Salaried individuals

- You need to be between 21 to 60 years of age at the time of application and with a certain monthly net income criteria set by the lender. Axis Bank’s minimum net monthly require is Rs 15,000.

The documents required for a personal loan are:

- Income statements

- Latest Income-Tax Returns

- Salary slips and Form 16

- Bank statements

- Qualification proof or registration proof (for practicing doctors, architects, CA, CS, ICWA, MBA consultants, engineers)

- Credit report

- Age proof (Passport, Aadhaar, PAN, etc.)

- Address proof (Aadhaar, Passport, electricity bill, telephone bill, ration card, etc.)

- Photo identification proof (Aadhaar, Voter Id, PAN, Passport, driving license, etc.)

These documents need to be submitted with the loan application form along with two photographs. The bank will then conduct a thorough due diligence based on the documents.

Once personal loan is sanctioned, before disbursement, a duly signed copy of the loan agreement and a standing instruction request / ECS mandate form, plus security deposit cheques are to be provided.

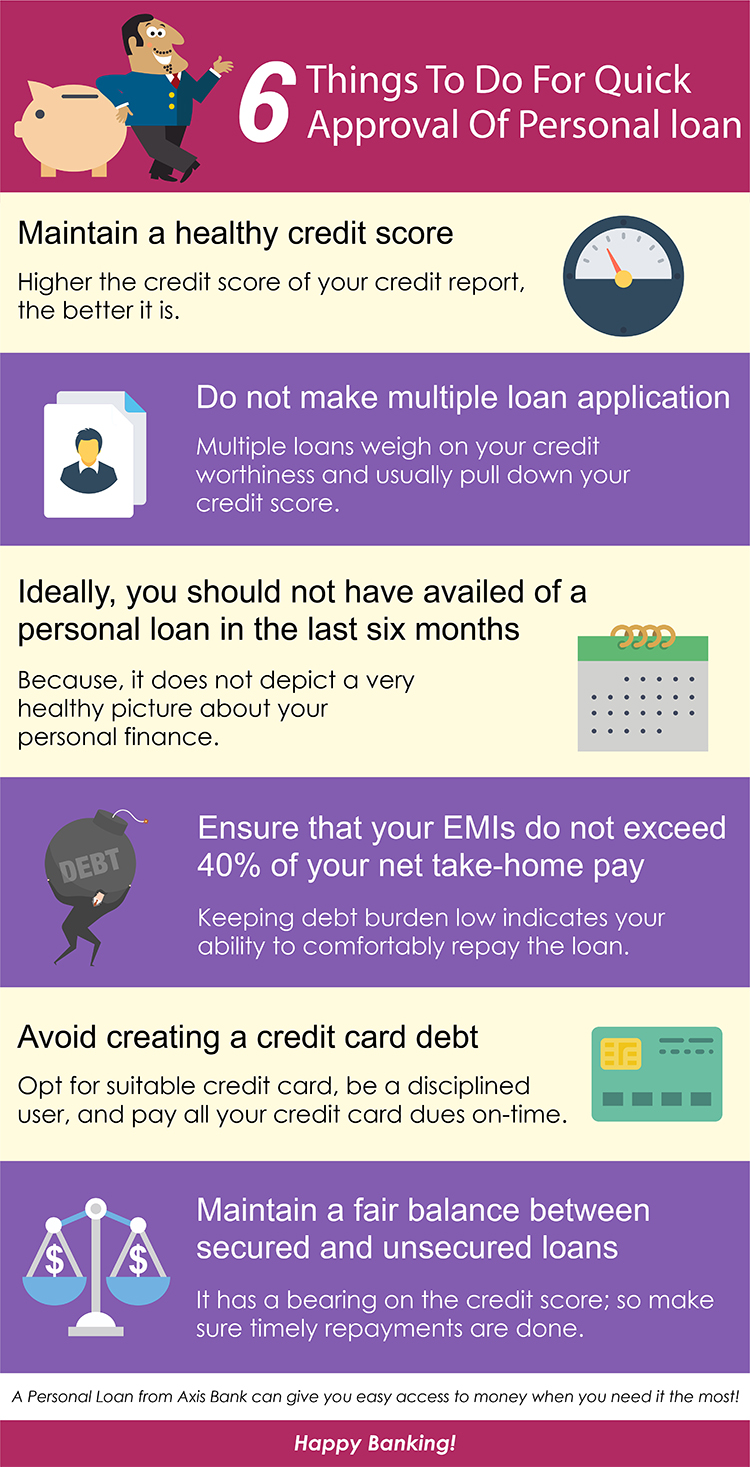

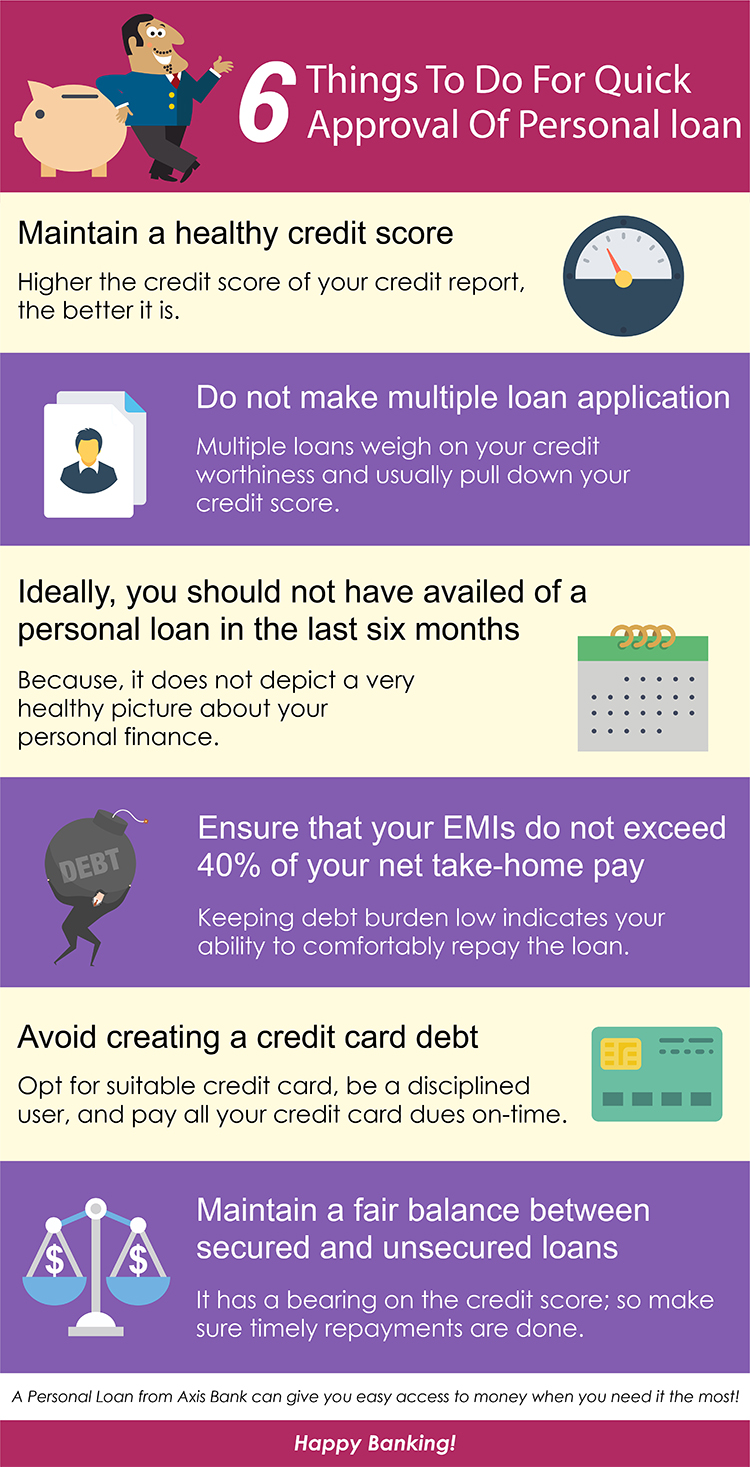

6 Things you should do to get a personal loan approved quickly:

1. Maintain a healthy credit score

Typically, your credit report (sourced from credit information companies viz. CIBIL, Experian, Equifax, Highmark, etc.) is scrutinised to judge the credit score. Higher your credit score, the better it is for you, the applicant.

A credit score reflects your credit behaviour and credit worthiness. A high credit score , gives you the power to bargain for the best rate of interest (which can reduce your EMI (or Equated Monthly Instalment, and/or ensure that the processing

fee on the loan is the least or even waived off.

To maintain a good credit score, always make it a point to pay your utility bills, credit card bill, and loans on-time.

2. Do not make multiple loan applications

When you apply for multiple loans, it weighs on your credit score. Too many loan applications weigh on your credit worthiness and usually pull down your credit score. Therefore, avoid applying to several banks or lenders for a loan.

Make sure you apply only at places where there’s a higher chance for your loan application getting approved. Check who’s offering the best deal, evaluate the loan application process, and the terms & conditions.

3. Ideally, you should not have availed of a personal loan in the last six months

If a bank or lender assesses that you have availed of a loan in the last six months, it does not depict a very healthy picture about your personal finance. It even questions your ability to repay owing to the increasing debt obligation.

Therefore, avail a personal loan thoughtfully when you are in dire need of funds and ensure that there’s a gap of at least six months between your loan applications.

4. Ensure that your EMIs do not exceed 40% of your net take-home pay

If you keep your debt burden is low, chances are that your personal loan will get approved quickly is higher.

Before sanctioning the loan, the bank or lender may want to evaluate if your income is sufficient enough after defraying for existing loans.

5. Avoid creating a credit card debt

Opting for a credit card is not a bad thing as long as it is used thoughtfully, and you have the means to service the dues.

Credit cards allow us to buy goods and services without paying for them immediately, but being a disciplined user and having a suitable credit card for your spends is equally important.

As far as possible, when you repay your credit card dues, avoid making partial repayments, as they can jeopardise your long-term financial wellbeing and impact your credit score.

Ideally, know your credit limit, the means to service the credit card dues, pay before the due date, avoid opting for grace period, avoid withdrawing cash on credit cards, and ensure the security of the credit card detail when using it online.

6. Maintain a fair balance between secured and unsecured loans

Loan taken against a collateral (for example: home loans, car loan, loan against gold) are classified as secured loans, while those without a collateral are classified as an unsecured loan. Personal loans, credit cards, are examples of unsecured

loans.

Ideally, a fair balance should be maintained between a secured and unsecured loan, since they have a bearing on the credit score. All loans should be repaid on time for it to appear reassuring to the lender.

If you have a lower credit score, make sure you fix it before applying for a personal loan.

- You can improve your credit score by:

- Using credit limits conservatively;

- Paying your dues on time;

- Repaying any late pending dues;

- Ensuring that they do not default on any payments in the future;

- Not opting for multiple credit cards;

- Maintaining a healthy balance between secured and unsecured loans; and

- Seeking help of a credit counsellor, if need be

- In addition to your credit score, a bank or a lender may also look at the following factor among a host of others before granting a personal loan:

- Your income

- The company you work for: whether private limited or public limited

- Nature of job/work

- Your residual working span

- Your average monthly bank balance

- Your investments

To conclude:

A personal loan can be used for a lot of purpose: wedding expenses, renovation of your home, travelling, emergencies, and so on.

The best part is, you do not need to touch your existing investments assigned for other important financial goals such as children’s future, their education and your own retirement.

- However, here’s what you should keep in mind while availing one:

- Check your credit score

- Calculate your affordability considering your need

- Compare offer, eligibility criteria, documentation, etc. across lender before you make the final choice

- Ask relevant question to the bank or lender

- Set your expectations right

- Ensure you are forwarding all the documents needed

- Keep your family in the loop

Meet all your aspirations. Consider a personal loan from Axis Bank and don’t let the need for money hold you back. Happy Banking!

Disclaimer: This article has been authored by PersonalFN, a Mumbai based Financial Planning and Mutual Fund research firm known for offering unbiased and honest opinion on investing. Axis bank doesn't influence any views of the author in any way. Axis Bank & PersonalFN shall not be responsible for any direct / indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information. Please consult your financial advisor before making any financial decision.