Now when you borrow money from banks, they charge compound interest. That means they charge you interest on interest pending.

Here’s what it would look like

Money owed = Principal + (Principal x Interest Rate x Time)

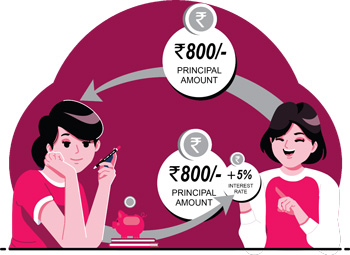

Let’s go back to the example with your friend.

Say your friend was charging you compound interest on the Rs 800 you borrowed.

For the first month, the money you owe remains the same.

Money owed = Principal + (Principal x Interest Rate x Time) = Rs 840

For the second month the total money owed becomes your new principal.

So the interest you will owe will be Rs 840 x 5/100 = Rs 42.

Now, the total amount you owe would be Rs 882.

If you don’t repay at the end of two months and the money becomes due at the end of three months, then Rs 882 becomes your principal. And so the story goes…

This way, you are paying interest on interest which means your interest is compounding.