4 minsDecember 6, 2017

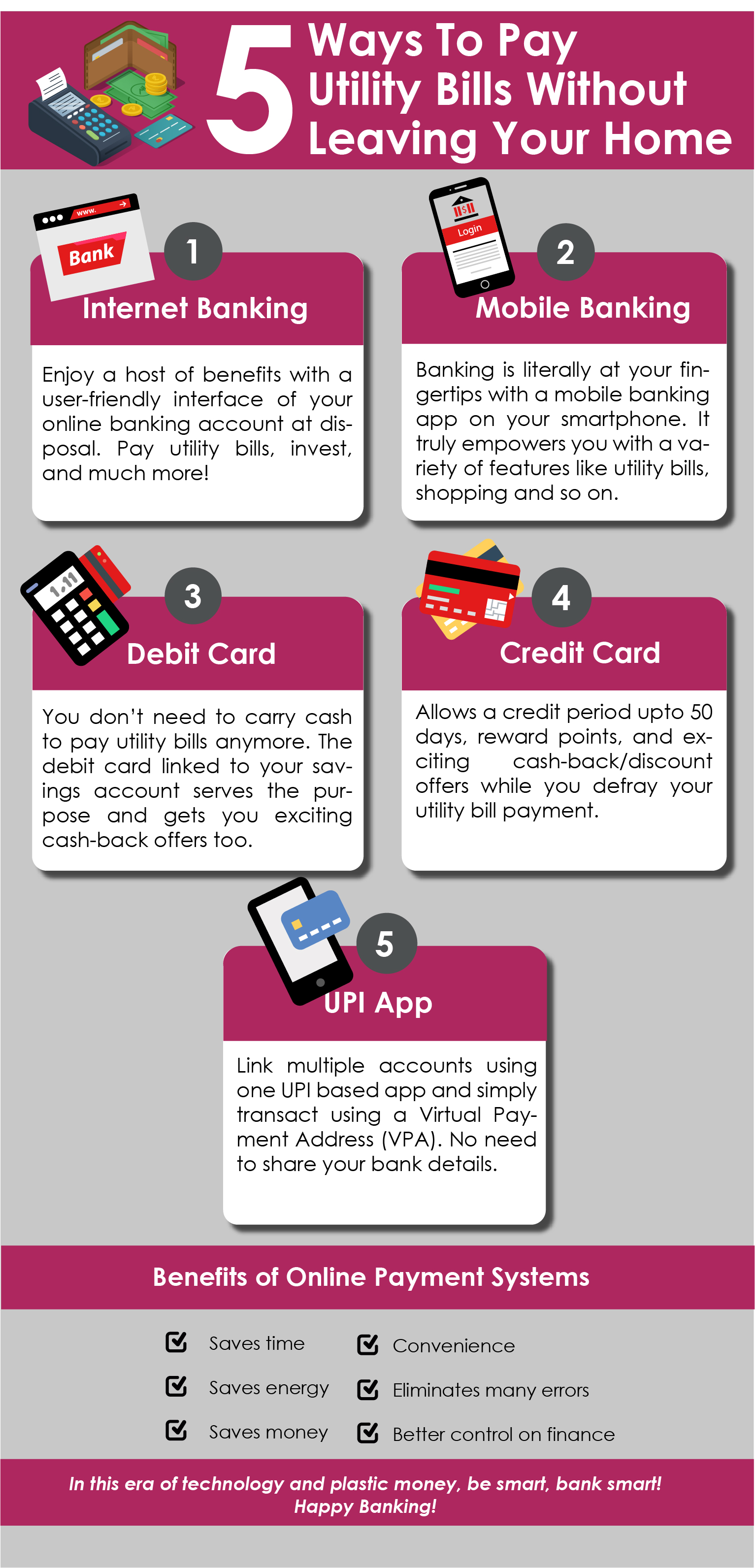

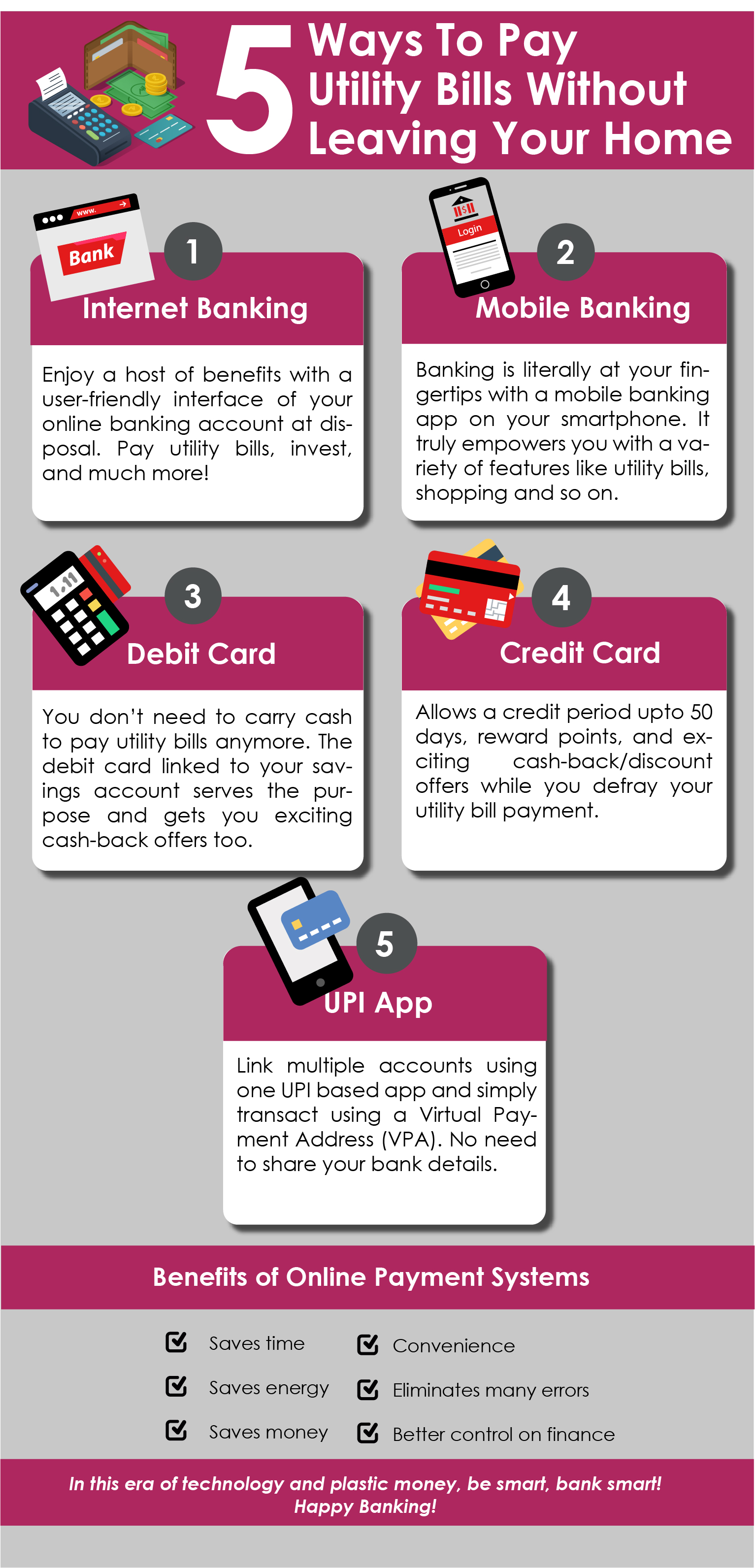

There’s so much that we can do on the internet today –– right from reading, taking up an online course, investing, to paying utility bills at our convenience, time, and with ease.

You can deal with a variety of tasks without leaving your home, or wherever you may be –– office, café, hotel, or even while travelling. All you need is a high-speed internet connection and a device (a laptop and/or a smartphone).

In the last few years, there’s paradigm shift in the way people transact, particularly after demonetisation. Across age groups and generations, ‘online’ has become a way of life with enough security measures in place.

Here are some benefits online payment systems have brought:

- Saves time;

- Save energy (otherwise spent on commuting and waiting in queues to pay utility bills);

- Saves money (on commuting, plus you benefit from e-coupons/promo codes);

- Convenience;

- Virtually eliminated many errors (with efficient processes & systems built); and

- Facilitates you to be in better control of your personal finance

Today online payment systems/platforms are available in areas such as investing, insurance, shopping, education, donations, journals and periodical subscriptions, professional fees, tax payments, and for a variety of utilities viz. landline bills,

mobile bills, piped gas bills, electricity bills, DTH recharge, data card recharge, toll payments, credit card bills, and so on.Axis Bank’s internet banking allows you do all this securely and conveniently.

Here are a few ways to pay utility bill smartly with ease and convenience:

Internet banking

Internet banking is a convenient way to bank–––anytime, anywhere–––for all Savings and Current account holders.

Axis Bank’s internet banking facility provides a host of benefits with a user-friendly dashboard

at disposal. It not only enables you to pay utility bills (with more than 160 billers listed), transact, and invest, but even allows you to have better control while managing personal finances.

Please note, at Axis Bank payment facility is free for you and there isn’t a separate registration form to avail ‘Bill Pay’ service. You can pay the bills in two ways:

- Auto pay on the due date (which will be automatically schedule the bill payment on the due date debiting your account); and

- Manual payment

Once the bill is paid, you even receive an e-mail confirmation (which serves as a receipt), SMS alerts, and the transaction reflects in your bank account as well. Axis Bank’s Bill Pay facility provides archiving facility for the bills you

have paid during the last twelve months.

Alternatively, you can even use the Direct Debit facility that allows you to make online payments at various merchants. And here the best past is that, there is no need to remember the debit card details. All you need is to log-in to net banking

and authenticate the transaction.

Mobile banking

Your smartphone is a smart tool, if used effectively. With a Mobile Banking App installed on your smartphone and registration completed, banking is literally at your fingertips. It empowers you do much more like paying various utility bills, make

travel plans, shop, invest, avail loans, mange your account, make a cheque book request, and so on.

Axis Bank’s mobile banking app has made banking simpler for you, and offers more than 60 features – click here to more about them. Axis Mobile can be used by Saving and Current account holders registered with either Internet banking

or who have an ATM-cum-Debit Card along with mobile number registered for SMS Banking. Standalone credit card customers too can use this app.

Debit Card

Your debit card linked to the savings account is also a medium to your utility bills. It is convenient and can be used across biller sites. You don’t

need to carry wads of cash to pay the monthly outgoings for the utility bills.

Axis Bank offers cash-backs on certain utility payments. This can aid you to save money while you spend it. And remember: money saved, is money earned!

Credit cards

Like debit cards, you can also use your credit card to defray utility bills. Using the credit card allows you earn reward points (which can utilised to purchase select merchandise), and avail of exciting cash-back/discount offers ––

help you save money.

Axis Bank credit cards offer unmatched privileges –– tons of deals and discounts. And the best part is, you can choose from a wide range of credit cards as per your requirements and get access to Axis Bank’s Edge Loyalty Rewards

Program.

UPI App

The Unified Payment Interface (UPI)——launched by the National Payments Corp. of India (NPCI)—— which went live last year, has further been a boon and brought a revolutionary change in the way transactions are performed.

UPI runs on Immediate Payment Service (IMPS) platform, and hence, the service is available 24X7. A sizeable number of banks today have their UPI apps.

Here are 7 key benefits of the UPI app:

- Facilitates quick, easy, cheapest way of money transfer anytime, anywhere

- You are not required to share your bank details –– simply transact using a Virtual Payment Address (VPA)

- No need to share or remember sensitive information

- You can link multiple accounts using one UPI based app and will no longer need different apps of different banks

- The QR Code Scan feature facilitates payment for online as well as offline purchases. All transactions are possible through this one app, as all your accounts can be linked to a single window.

- Collect Payment service has made it easier to ask for payments

- Fund settlement is on real-time basis

Besides the above key benefits, most UPI apps also offer a dashboard for you to do a variety of things. To pay your utility bills, make it a point to use the UPI app by downloading it on your smartphone.

You can download ‘Axis Pay UPI App’ following these 4 simple steps:

Step #1: Download the Axis Pay UPI App (from Play Store for android users or App Store

for iOS users and complete the verification process)

Step #2: Create a Virtual Payment Address, which can be as simple as your name or mobile number followed by the bank address (For eg. be "yourname@axisbank" or “9800000111@axisbank”)

Step #3: Link your bank account from a list of banks. (Once you select the bank, it’s sorted; you no longer have to submit your account details. It will automatically fetch all your details.)

Step #4: Send and Receive Money using UPI app (Once registered, you can then start transferring – paying / receiving – money immediately.)

(If you wish to know more, read: Get Ready To Use The UPI App in 4 Easy Steps) UPI is a direct account to account transfer using your

VPA. Plus, the daily transaction limit for UPI is Rs 1 lakh, much higher than mobile wallets.

Axis Pay UPI App can be used by both Axis Bank and other bank customers. With the app, payments to merchants are possible vide their e-commerce platform or retail outlet using your VPA.

End note:

In this era of technology and plastic money, be smart, bank smart! Set a calendar with alerts to pay your utility bills on time; it can earn you a good credit score!

Happy Banking!

Disclaimer: This article has been authored by PersonalFN, a Mumbai based Financial Planning and Mutual Fund research firm known for offering unbiased and honest opinion on investing. Axis bank doesn't influence any views of the author in any way. Axis Bank & PersonalFN shall not be responsible for any direct / indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information. Please consult your financial advisor before making any financial decision.