The primary goal of a central bank is to maintain optimal economic conditions in a country, characterised by maximum employment and stable inflation. They achieve this by using monetary policy rates to manage economic growth and control inflation. When the economy slows down, the central bank can lower its key interest rates to help stimulate growth. However, if rates are already low and growth remains stagnant, central banks may resort to alternative measures such as Quantitative Easing (QE) to give the economy an extra boost. Let's explore the dynamics of Quantitative Easing and Tightening and their impact on an economy.

What is Quantitative Easing (QE) and how does it function?

Back in 2007-2008, the whole world felt the impact of the Global Financial Crisis triggered by the bursting of the US housing bubble. To tackle the slowdown, central banks worldwide began reducing interest rates. Developed economies like the US and Eurozone went as far as dropping their rates to almost zero, running out of room for more cuts. However, even with these measures, economies couldn't recover as expected. To address this, the US Federal Reserve decided to take an unconventional route. They initiated a huge asset purchase program, also known as Quantitative Easing (QE), to revitalise the economy.

Let's break down how QE gets things moving. The central bank begins by purchasing financial assets, primarily long-term government and corporate bonds, from the open market. This action aims to increase the money supply and drive down interest rates. The central bank expands its balance sheet by digitally creating additional money to finance these bond purchases. These bonds are held as assets, simultaneously increasing bank reserves as liabilities.

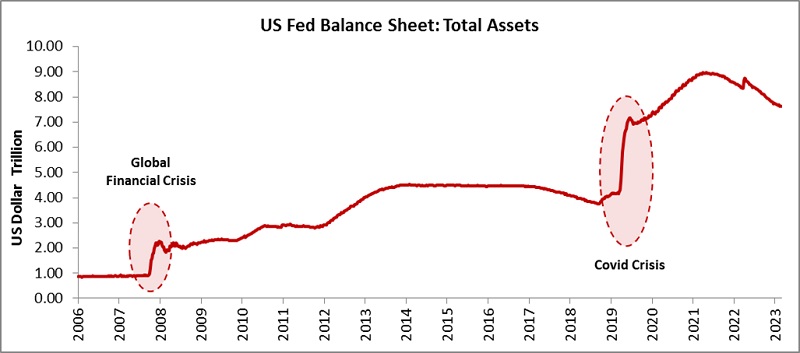

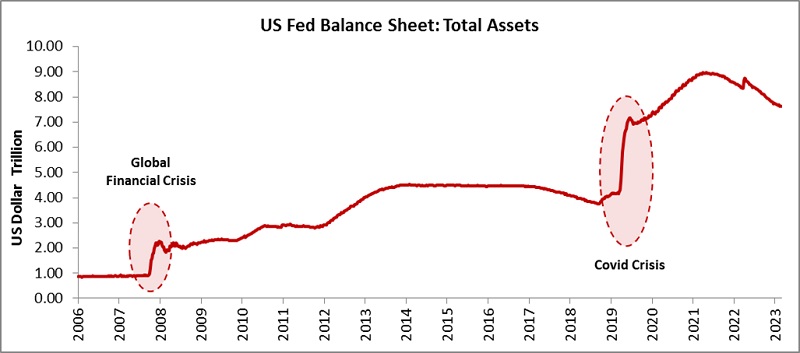

The US Federal Reserve implemented QE in three phases between 2008 and 2014, acquiring US treasuries and mortgage-backed securities (MBS). This move significantly increased the securities held by the Fed from $0.8 trillion before the financial crisis to $4.2 trillion by the end of 2014. Furthermore, in 2020, the US Fed initiated additional asset purchases to support the economy during the COVID crisis. Consequently, the assets on the Fed’s balance sheet surged to $8.94 trillion as of March 2022.

Source: https://fred.stlouisfed.org/

The goal of QE is to bolster the money supply and reduce interest rates by infusing money into the system. This increased liquidity incentivises banks to extend credit to businesses and consumers at more favorable interest rates. Consequently, this increased liquidity stimulates consumption and provides cheaper capital for investments, ultimately driving economic growth.

Now, let’s delve into the reasons behind the necessity to taper QE.

What is Tapering of QE?

Tapering of QE refers to the gradual reduction of the central bank's quantitative easing programme. While QE can initially boost the economy, prolonged stimulus may lead to overheating and hyperinflation. Thus, once economic stability is attained, it becomes crucial for a central bank to taper QE by slowing down its pace. However, implementing this reduction can be challenging, as demonstrated by the notable 'Taper Tantrum' incident in 2013. When the US Fed hinted at tapering QE, markets reacted adversely, causing a sharp increase in US bond yields and a significant sell-off in global equity markets. It's important to note that tapering QE differs from Quantitative Tightening, where the central bank actively reduces its balance sheet and liquidity in the financial system.

What is Quantitative Tightening (QT) and how does it work?

Quantitative Tightening (QT) operates as the opposite of Quantitative Easing (a countermeasure to QE). It’s essentially a strategy known as balance sheet normalisation, where a central bank implements a contractionary monetary policy by reducing its balance sheet. This can be done in two ways: either by selling bonds in the open market or by allowing bonds to mature and gradually removing them from their reserves. In May 2022, the US Fed announced its implementation of QT alongside raising the federal funds rate to rein in high inflation.

The primary aim of QT is to trim the money supply and reduce the excess liquidity held in the system. As more bonds are available in the market, their demand decreases, and potential buyers demand higher yields. This uptick in yields results in an overall increase in interest rates across the economy. Consequently, this rise in rates discourages both corporates and consumers from borrowing more. With reduced borrowing and spending, there is a decrease in demand for goods and services, eventually stabilising the inflationary pressure.

Also Read: Managing economic cycles with fiscal and monetary policies

Conclusion

Quantitative easing and tightening are monetary policies aimed at managing economic growth and controlling inflation. While these unconventional monetary policies are commonly utilised in developed economies such as the US, they are not as frequently adopted by developing economies like India. Nevertheless, the implementation of QE and QT in developed economies like the US does have a ripple effect on capital flows in developing nations, consequently impacting their financial markets.

Disclaimer: This article is for information purpose only. The views expressed in this article are personal and do not necessarily constitute the views of Axis Bank Ltd. and its employees. Axis Bank Ltd. and/or the author shall not be responsible for any direct / indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information. Please consult your financial advisor before making any financial decision.