Inflation has always been a part of our daily conversations because it hits us right where it hurts – our wallets. But is inflation really a bad thing? If yes, how is it managed? And how does it impact the interest rates at which you invest and borrow? As an investor or borrower, you must know the answers to these crucial questions. Read on as we decode the interplay between inflation and interest rates.

Inflation – what makes prices rise?

Inflation, or a general rise in prices, is a byproduct of growth in the economy. If the country’s gross domestic product (GDP), which is the total output created in the economy, grows sharply, it will reduce unemployment and increase wages. Due to this, people will have more money in their hands to spend (boosting the money supply). Furthermore, due to high liquidity banks will also be eager to give more credit to their customers.

As a result, there will be a positive consumer sentiment due to which aggregate demand will outpace the aggregate supply available in the economy. And the rule of economics says if demand is higher than supply, the price increases. Thus, a country as a whole will witness a general rise in the prices of goods and services. Another contributing factor to inflation is the rise in input costs. When raw material costs surge, businesses are compelled to increase their product prices, regardless of demand, thereby contributing to inflation.

So, is inflation good or bad?

Now you must be wondering if inflation is a sign of growth in the economy, then why worry about it? Well, the problem lies in extremes. You see, a steady inflation is good for the economy. However, when inflation becomes very high or even reaches a level called hyperinflation, that's when problems arise. On the flip side, having very low inflation or deflation can also harm the economy.

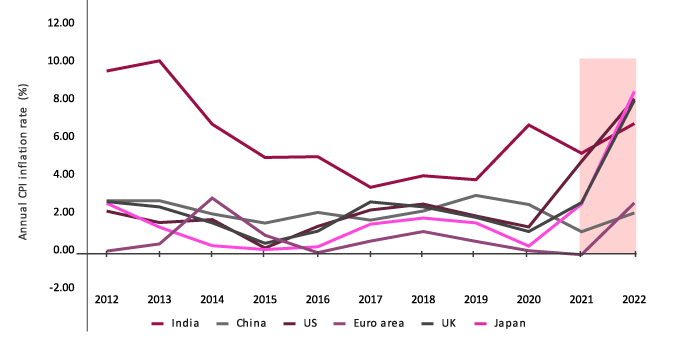

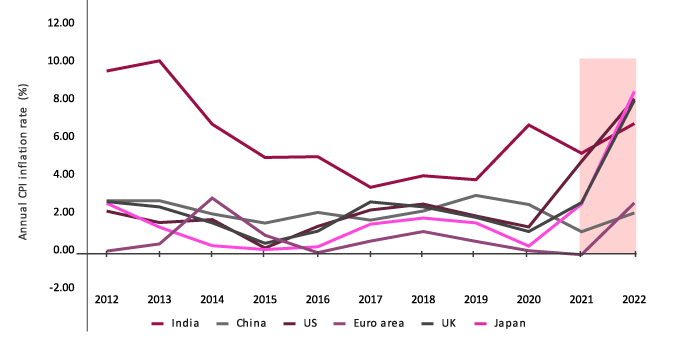

Emerging economies like India and China typically have high inflation due to higher growth, while developed economies like the US, the UK, and the Eurozone nations, where growth is slower, tend to have lower inflation rates. Then we also have countries like Japan which has had no growth for decades and is thus witnessing deflation.

Since the COVID-19 pandemic, inflation has shot up globally. Especially in the US and other developed countries, inflation has risen to decadal-high levels as seen in the below chart. This happened due to global supply chain disruption and the huge fiscal and monetary stimulus provided to boost growth.

Source: World Bank

How is inflation managed in the economy?

It's the central bank's job to control inflation in a country – in India, that's the RBI, in the USA, it's the Federal Reserve, and so on. These central banks usually set a target for inflation which is considered normal. For example, the RBI aims for 4% inflation (with a 2% leeway on both sides), while the US Fed targets 2%.

Now, things are just peachy if inflation stays close to that target, but trouble brews when it strays too far from it. So, you might be wondering, how does the RBI tackle inflation? Well, they use monetary policies as a tool to battle against it.

Which monetary policy tools does the RBI use to manage inflation?

Just like a driver uses the accelerator and brakes to control a car's speed, the RBI employs monetary policy tools to either increase or decrease the money supply and, consequently, manage inflation in the economy. When dealing with high inflation, the RBI applies a temporary brake to the money supply by typically raising the repo rate and the cash reserve ratio (CRR), among other options.

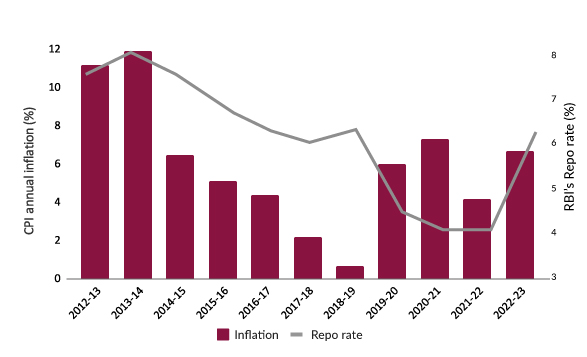

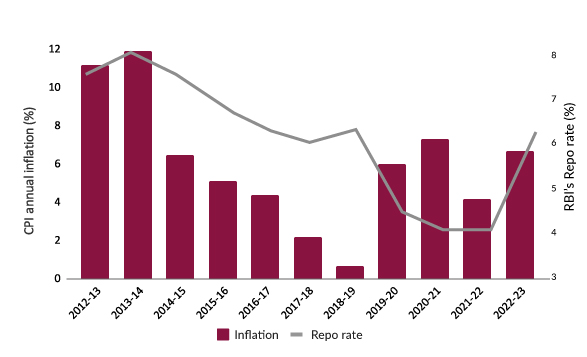

The repo rate is the interest rate at which the RBI lends money to banks, and the CRR is the portion of deposits that banks must keep with the RBI. By increasing both of these rates, the money supply is reduced, and inflation is brought under control. The graph below illustrates the pattern of inflation and the RBI's policy measures (repo rate) to manage it.

Source: RBI

How is inflation interlinked with interest rates?

When the RBI increases the repo rate or CRR to combat inflation, it causes a reduction in the money supply, leading to an increase in the interest rates that banks offer for both deposits and loans. Elevated interest rates encourage savers to invest more, while at the same time, borrowers are less inclined to take out loans. This continues until inflation returns to its normal levels.

Conversely, when inflation is too low due to sluggish economic growth, the RBI boosts the money supply to stimulate that growth. With a higher money supply, interest rates decrease. In this scenario, savers are less motivated to invest and tend to spend more. Borrowers, on the other hand, find it more appealing to take out loans at lower rates. Both of these actions contribute to the economy's growth and, as a result, lead to an increase in inflation.

Also Read: [How inflation affects your home loan interest rate ]

Summing up

Interest rates in the economy closely follow inflation. Therefore, it's essential for investors and borrowers not to overlook the impact of inflation when making financial decisions. Investors should opt for financial products that have the potential to generate returns that can beat inflation in the long run. Since rising inflation often results in higher interest rates, borrowers may find themselves facing increased EMI outgo. However, they have the option to maintain their EMI expenses by extending the loan tenure or making partial payments.

Disclaimer: This article is for information purpose only. The views expressed in this article are personal and do not necessarily constitute the views of Axis Bank Ltd. and its employees. Axis Bank Ltd. and/or the author shall not be responsible for any direct / indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information. Please consult your financial advisor before making any financial decision