The economy goes through cycles. In a normal economic cycle, a nation’s economic activity moves from expansion to contraction and back again. Because these shifts have implications on what we earn, spend, invest, and borrow, it’s a good idea to learn how the economic cycles work and how they are managed. In this article, we decode the role of fiscal and monetary policies in managing the economic cycle.

How does the economic cycle operate?

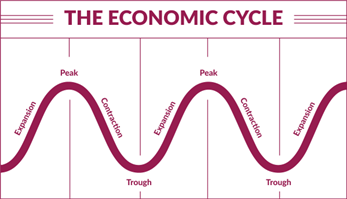

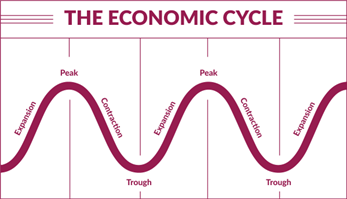

Well, a typical economic cycle goes through four stages – expansion, peak, contraction, and trough. The expansion phase is when things are looking up – there's robust growth, and key macroeconomic indicators like production, employment, wages, corporate profits, consumer confidence, and credit growth are on the rise. Inflation also tends to creep up during this period.

However, there's a catch: the economy can get overheated, and this leads to the peak. At the peak, economic activity plateaus, and the growth trend starts to reverse. It's like hitting a high point and then slowing down.

After the peak, a contraction follows. Here, demand for goods and services dwindles, and all major economic indicators start heading south. If a country's GDP experiences negative growth for two consecutive quarters, it technically falls into a recession. On a global scale, we've witnessed many global recessions like in 1975, 1982, 1991, 2009, and the latest being the Covid-led slowdown in 2020.

The downturn eventually reaches its lowest point, known as the trough (the opposite of the peak). From this low point, the cycle begins to reverse, and the economy slowly starts showing signs of recovery. Now, let's dive deeper into how governments and central banks manage these economic cycles to create a stable economic environment.

What is fiscal and monetary policy?

Fiscal and monetary policy are widely used tools across countries to regulate economic activities. Their primary goals are to give a boost during economic downturns and prevent the economy from overheating during periods of expansion.

Fiscal policy is the government's way of fostering economic growth and redistributing income and wealth. It involves making decisions about taxes, government spending, and borrowing. Governments can choose to either stimulate growth (through expansionary fiscal policy) or put the brakes on it (through contractionary fiscal policy) to manage the economy effectively.

On the other hand, monetary policy is handled by a central bank, like the Reserve Bank of India (RBI) in the case of India. Its focus is on managing the flow of money (liquidity), controlling inflation, setting interest rates, and regulating credit in the economy. The RBI uses tools such as the Repo rate, Reverse Repo rate, Cash Reserve Ratio (CRR), Statutory Liquidity Ratio (SLR), Marginal Standing Facility (MSF), and Open Market Operations (OMOs) to fine-tune the economy's financial dynamics.

How are economic cycles managed through fiscal and monetary policies?

You've probably heard the expression, “One person's spending is another person's income,” right? Well, fiscal and monetary policies are essentially guided by this idea. They aim to pump money into the economy so that people have more to spend, which, in turn, has a multiplier effect on overall consumption and aggregate demand in the economy.

When the economy is facing a recession or slowdown, the government takes up an expansionary fiscal policy approach. This involves reducing taxes and increasing spending on public projects, subsidies, and social welfare programs. To give you an example, in the fiscal year 2020-21, the government significantly boosted its total expenditure by a whopping 31%, totalling Rs 35 trillion, as a response to the economic challenges posed by the Covid-19 pandemic.

By injecting more money into the system through various initiatives, the government aims to create more jobs and increase disposable income. Consequently, this boost in spending stimulates consumption, which, in turn, ignites overall demand in the economy.

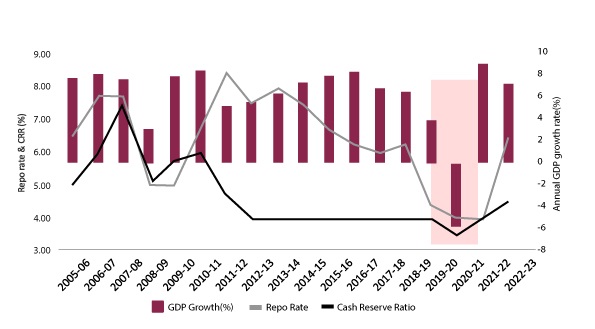

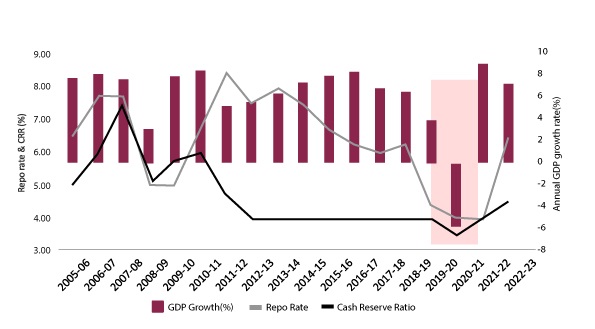

A similar effect is also achieved when the RBI implements an accommodative monetary policy. This includes reducing key interest rates (like the Repo rate), reserve requirements (CRR), or purchasing government bonds through OMOs. For instance, in response to the Covid-19 pandemic, the RBI adopted a multi-pronged approach by announcing liquidity-boosting measures totalling Rs 12.8 trillion in February 2020. The RBI also lowered the repo rate by a cumulative 115 basis points to 4% and reduced the CRR by 100 basis points to 3% (as shown in the chart) during the pandemic crisis.

The goal of monetary policy is to infuse more money into the system, leading to lower interest rates. This encourages savers to invest less at these lower rates and instead spend more, while borrowers are incentivised to take more loans at cheaper rates. In essence, increased consumption acts as a catalyst for revitalising economic growth.

Source: RBI, MOSPI

Likewise, when the economy is running too hot and experiencing significant inflationary pressure, the government adopts a contractionary fiscal policy. This involves increasing taxes and cutting back on expenditures. Simultaneously, the RBI tightens its monetary policy by raising the Repo rate, CRR and employing other tools to reduce the money supply, which, in turn, increases interest rates and helps cool down inflation.

Also Read: [How a change in RBI’s repo rate impacts your home loan EMIs? ]

So, in a nutshell, excessive spending and increasing the money supply through fiscal and monetary means can pose the risk of triggering high inflation and burdening the country with substantial debt (especially when the government’s spending exceeds its revenue). Conversely, excessive tightening measures can also harm overall demand and potentially hinder economic growth. Thus, both policies must strike a delicate balance on a tightrope to ensure a stable and steady path for economic growth.

Disclaimer: This article is for information purpose only. The views expressed in this article are personal and do not necessarily constitute the views of Axis Bank Ltd. and its employees. Axis Bank Ltd. and/or the author shall not be responsible for any direct / indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information. Please consult your financial advisor before making any financial decision