Tracking your Mutual Fund portfolio’s performance is crucial for earning consistent returns. By monitoring returns, you can make informed decisions and take corrective actions when needed. Two common methods to measure the returns on Mutual Funds are extended internal rate of returns (XIRR) and CAGR (compound annual growth rate), each suited for different scenarios.

XIRR meaning

XIRR, also known as Extended Internal Rate of Return) is a rate of return computed when investments and withdrawals happen at irregular intervals, and each amount remains invested for a different duration. This is ideal for calculating SIP returns accurately.

XIRR calculates the single return rate that results in the current total investment value when applied to each instalment and redemption. It is calculated using MS Excel function that determines the annualised returns based on actual investment dates and amounts.

CAGR meaning

CAGR is the average yearly rate of return for a Mutual Fund. It is calculated for a specified period, assuming the returns compound yearly.

CAGR = [(EV/BV)^1/n]−1

Where:

- EV = End value

- BV = Initial value

- n = Number of years

Difference between XIRR and CAGR

|

XIRR |

CAGR |

|---|

| Timing of cash flows | Accounts for multiple cash inflows and outflows. | Assumes a single investment and a single redemption. |

| Duration | Considers actual time gaps between investments and withdrawals | Assumes a fixed time duration for the entire investment. |

| Suitability | Suitable for investments with variable cash flows like SIPs. | Useful for lump sum investments with a fixed holding period. |

XIRR vs CAGR: Pros and cons

XIRR pros

- Accounts for multiple investments and withdrawals.

- Considers actual timing of cash flows.

XIRR cons

- Requires complex mathematical calculations. You may need to use Excel or other financial tools.

CAGR pros

- It is easy to calculate.

- Useful for comparing long-term investments with a fixed time frame.

CAGR cons

- Assumes a constant growth rate, which rarely happens in real investments.

- It can only be used for investments made in one go.

Examples of CAGR and XIRR

1. CAGR example

Let's calculate the CAGR for a Mutual Fund purchased at ₹1,00,000 and redeemed at ₹1,50,000 after 3 years.

CAGR = [(150000/100000)^1/3]−1

=0.1445, or 14.45%

2. XIRR example

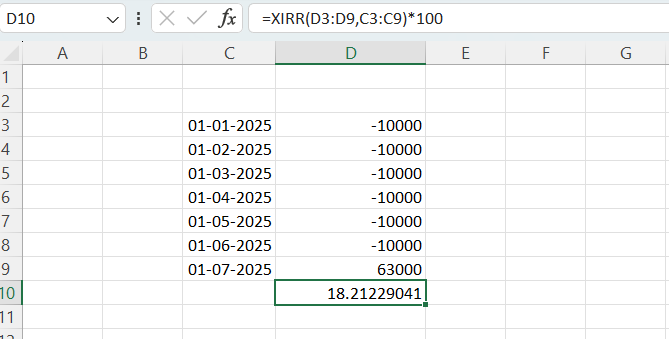

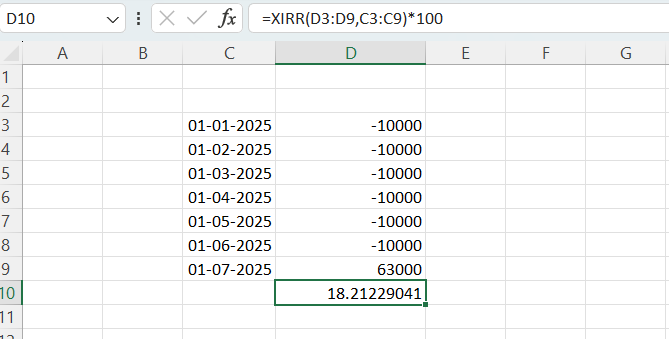

Let's calculate XIRR for a monthly SIP of ₹10,000 for 6 months. Let's assume that it was redeemed for ₹63,000 after 6 months.

| 01-01-2025 | -10,000 |

| 01-02-2025 | -10,000 |

| 01-03-2025 | -10,000 |

| 01-04-2025 | -10,000 |

| 01-05-2025 | -10,000 |

| 01-06-2025 | -10,000 |

| 01-07-2025 | 63000 |

Use the formula XIRR= (value range, date range) in Excel to get an XIRR of 18.21%

Conclusion

There is no better or worse option for XIRR vs CAGR because both serve different purposes. Compute XIRR for your SIP investments and CAGR for your lump sum investments.

Also Read: How to invest in Mutual Funds in 7 easy ways

FAQs

Can we convert XIRR to CAGR?

No, we cannot because XIRR and CAGR measure returns differently.

Which is better: XIRR vs CAGR?

XIRR is better for investments with multiple cash flows, while CAGR is ideal for lump sum investments with a fixed holding period.

How do changes in the frequency of cash flows affect the calculations of XIRR and CAGR?

XIRR fluctuates with the timing and amount of cash flows, while CAGR remains unchanged as it only considers the start and end values.

Why is XIRR used to calculate returns from SIP and not CAGR?

XIRR accounts for multiple investments at different times, making it more accurate for SIPs.

Disclaimer: This article is for information purpose only. The views expressed in this article are personal and do not necessarily constitute the views of Axis Bank Ltd. and its employees. Axis Bank Ltd. and/or the author shall not be responsible for any direct / indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information. Please consult your financial advisor before making any financial decision.

Mutual Fund investments are subject to market risk, read all scheme related documents carefully. Axis Bank Ltd is acting as an AMFI registered MF Distributor (ARN code: ARN-0019). Purchase of Mutual Funds by Axis Bank’s customer is purely voluntary and not linked to availment of any other facility from the Bank. T&C apply.