Home Loans have made it possible for many people to realise their dream of owning a home. While longer tenure loans are preferred by many as EMIs are manageable, many also look out for ways to reduce or pay off their liabilities. Home Loan prepayment is one such approach that can help you achieve that and can be considered a wise decision in the long run.

How can you benefit from prepaying your Home Loan?

Here’s looking at some of the reasons why you should consider prepaying your Home Loan whenever possible.

It helps you save on the interest cost

Home Loans are significant debts having a large portion as interest. When you prepay your loans before the completion of the tenure, you save substantially.

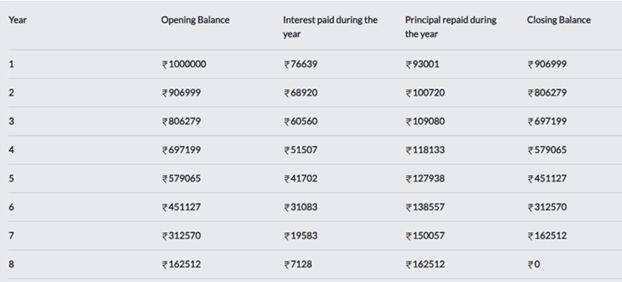

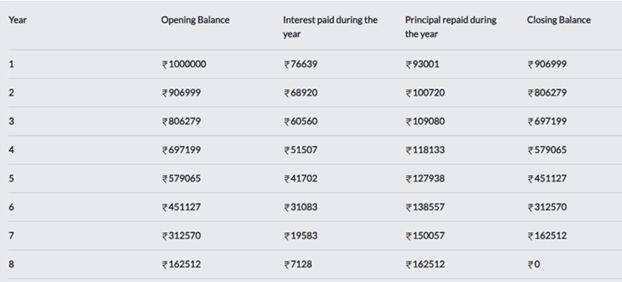

Look at this amortisation schedule for a Home Loan of ₹10 lakh at an interest rate of 8% p.a. for a tenure of 8 years.

In the above example, the total interest amount throughout the loan tenure of 8 years is ₹3.57 lakh. If you prepay your loan early in the tenure, you can save a lot on the interest cost. Also, the interest cost saved can be used to fulfil other life goals like funds for your child’s education, retirement planning, etc.

Also Read: Strategies to lower Home Loan EMI burden

Improve your credit score

Paying off your loans before the end of the tenure would mean your credit usage ratio falls. Lower credit utilisation has a positive impact on your credit report, and your overall credit score improves. We know that credit scores depend extensively on your ability to repay your loans. While timely repayments are good for maintaining a strong credit score, prepayment is an excellent way to build as well as maintain a good credit score.

Improve your chances of availing other loans easily

As mentioned earlier, prepayment of your Home Loan helps improve your credit score. With a better credit score, your chances of availing of other loans, such as car loan, business loan, education loans, etc., increases.

Avoid repayment defaults

If you pay off your portion of the loan early, it may help you save from repayment defaults arising in case of emergency or difficult situations. You surely do not know what the future holds for you, but it does make sense to pay off the portion of your Home Loan as soon as possible (if you have funds) to avoid any financial hiccups later.

Also Read: Avoid common Home Loan application mistakes

Things to keep in mind before prepaying your Home Loan

Since we have learnt the benefits of prepaying Home Loans, here are a few things you must consider before taking this step.

- Assess your current and future financial needs.

- Try to have a sufficient emergency fund to meet any unforeseen expenses.

- Check if there is any prepayment lock-in tenure.

- Be aware of any prepayment penalty. Typically, Home Loans which are taken on fixed interest rates charge a prepayment penalty.

- If you pay off your Home Loan early, you might not get the tax deduction. Check how it could affect your overall taxes before doing so.

Conclusion

Prepayment of Home Loans is best suited for individuals with spare or additional funds. With this, you can lower your credit burden, improve your credit score and create funds for important financial goals. At Axis Bank, we understand the challenges of managing a Home Loan, and we are here to help you every step of the way. Our Home Loans come with flexible EMI options, competitive interest rates, and a range of other features that can make your home buying experience hassle-free.

Also Read: Secure independence from renting - own home via Home Loans

Disclaimer: This article is for information purpose only. The views expressed in this article are personal and do not necessarily constitute the views of Axis Bank Ltd. and its employees. Axis Bank Ltd. and/or the author shall not be responsible for any direct / indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information. Please consult your financial advisor before making any financial decision