Four years ago, we embarked on a new journey to realise the true potential of Axis. Since then, we have scaled new heights on the back of our One Axis proposition, through which we offer a host of banking and financial services. We also unveiled our GPS strategy which enables us to unlock Growth, Profitability and Sustainability (GPS) as we progress. Finally, with our philosophy of 'Open', we have built and delivered winning propositions for our stakeholders.

To be the preferred financial services provider excelling in customer service delivery through insight, empowered employees, and smart use of technology

Read MoreDeliver world-class customer experience

Leadership in digital and technology

Build India’s most profitable Bharat Banking franchise

With the acquisition of the Citibank India Consumer Business, we have gained

access to a large, affluent, and profitable

customer franchise, which aligns well

with our premiumisation strategy. The acquisition is a healthy and strategic

fit in

line with our GPS strategy, powering us to build one of India's most

premium franchises.

Citibank India's Consumer Business Acquisition Aligns

with Our

Premiumisation Strategy

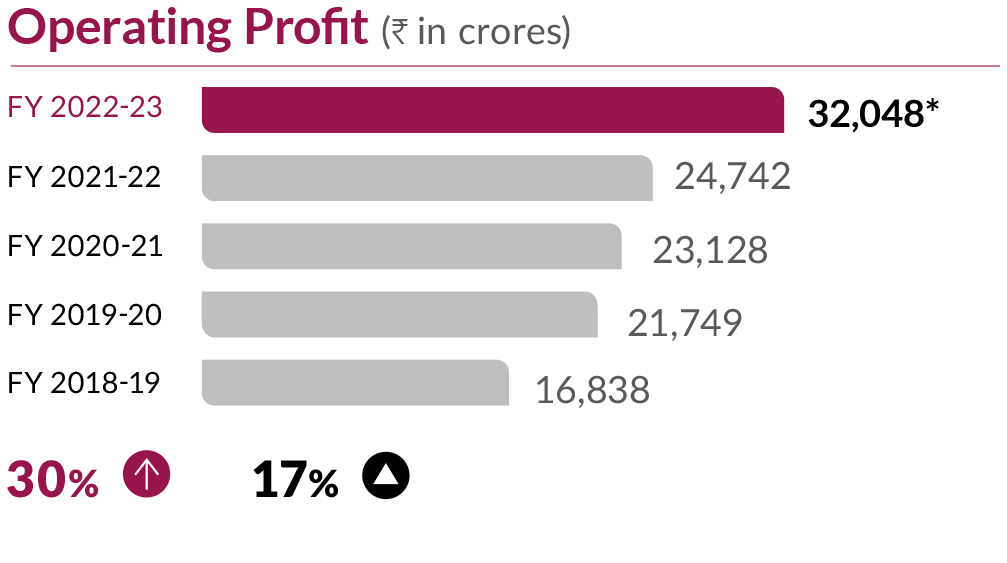

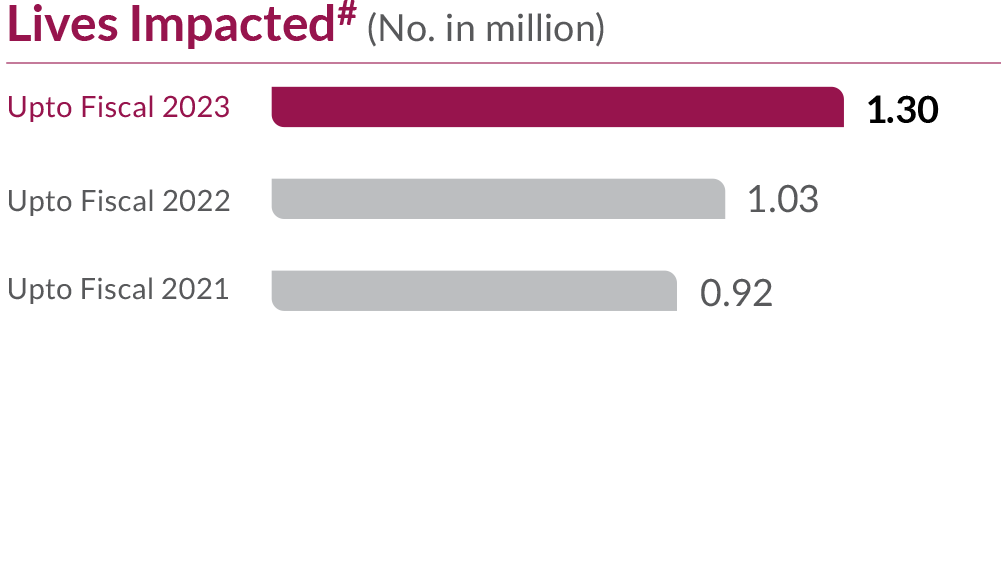

*Includes amount transferred to Unspent CSR accounts to be utilised in

ongoing programmes in subsequent years

#Under the Sustainable Livelihoods Program

Above are standalone figures as on/for year ended March 31, 2023 unless otherwise mentioned