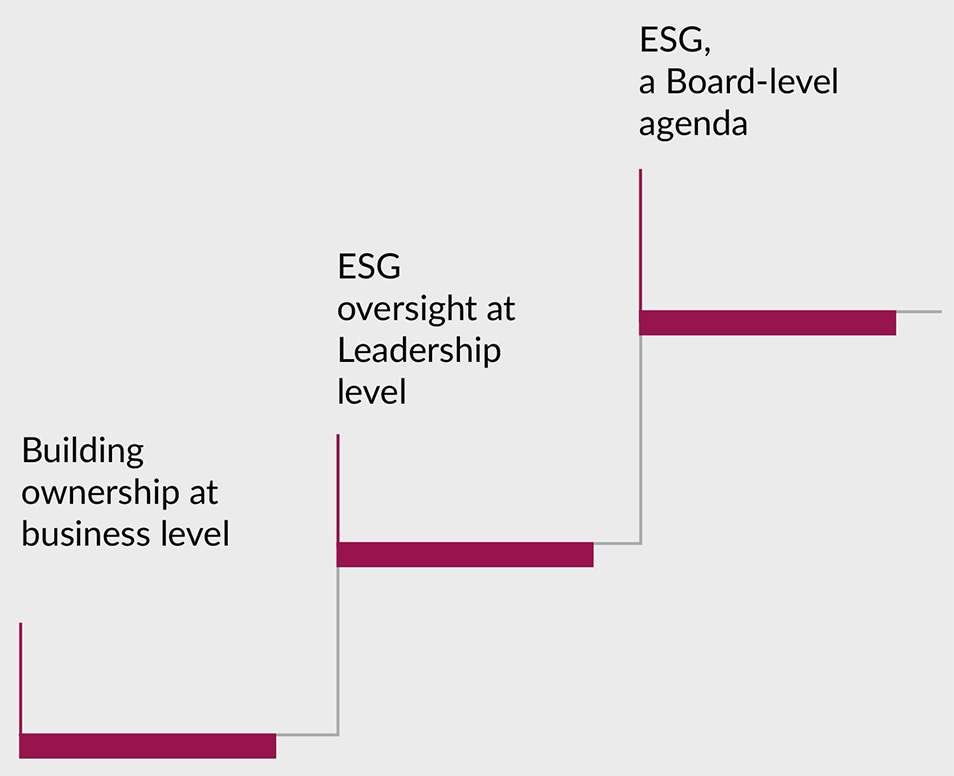

Axis Bank is the first Indian Bank to constitute an ESG Committee of the Board

ESG-aligned commitments

Progress in fiscal 2023

Aspirations for fiscal 2024

ESG-aligned commitments

Incremental financing of ₹30,000 crores under Wholesale Banking to sectors with positive social and environmental outcomes, by fiscal 2026

Progress in fiscal 2023

Achieved incremental exposure of ₹20,400 crores cumulatively as of March 2023

Aspirations for fiscal 2024

Continue the current pace of incremental exposure towards the final target

ESG-aligned commitments

Making 5% of its retail two-wheeler loan portfolio as electric by fiscal 2024

Progress in fiscal 2023

Achieved EV penetration of 2.5% in overall retail two-wheeler loan portfolio as of March 2023

Aspirations for fiscal 2024

Achieve targeted penetration of 5% by March 2024

ESG-aligned commitments

Incremental disbursement of ₹10,000 crores by fiscal 2024 under Asha Home Loans for affordable housing, increasing share of women borrowers from 13.9% to 16.9%

Progress in fiscal 2023

Achieved cumulative disbursement of

₹7,970 crores as at March 2023

Share of women borrowers reached

over 18% as of March 2023

Aspirations for fiscal 2024

Achieve incremental disbursement of ₹10,000 crores by March 2024

ESG-aligned commitments

Scaling down exposure to carbon-intensive sectors

Progress in fiscal 2023

Glide path up till 2030 finalised and being tracked internally by the ESG Committee of the Board

Aspirations for fiscal 2024

Continue on the internal glide path

ESG-aligned commitments

Reaching 30% female representation in workforce by fiscal 2027

Progress in fiscal 2023

Overall diversity at 26% as of March 2023

Aspirations for fiscal 2024

Achieve 27% overall diversity

ESG-aligned commitments

Planting 2 million trees by fiscal 2027 across India towards contributing to creating a carbon sink

Progress in fiscal 2023

0.83 million saplings planted as of March 2023 across 5 states

Aspirations for fiscal 2024

Plant 1.5 million saplings cumulatively by March 2024

Steady Performance on Global ESG Benchmarks

Above 80th percentile among global banks on Dow Jones Sustainability Index in 2022

6th Consecutive year on FTSE4Good Index in 2022

MSCI ESG Ratings at A in 2022

CDP Score at C in 2022