One of the fastest growing MF player

Leadership position in ECM deals segment

AAA rated NBFC with diversified product offerings

3rd largest Bank led brokerage firm

Amongst the leading trustees in India

One of the major fintech players in India

Leading player on TReDS platform

4th largest private insurance company (Co-promoter)

5th rank in terms of subscriber addition since inception

The aforementioned numbers represent the stake in respective group entities

Axis Finance Ltd

Through Axis Finance, our AAA rated diversified NBFC arm, we provide wholesale and retail lending solutions to corporate and retail customers across geographies and businesses. Axis Finance is one of India's most rapidly growing NBFCs, with a 43% CAGR in AUMs (Assets Under Management) from fiscal 2020 to fiscal 2023. This can be attributed to our strong operational and risk management practices, supported by the dependable technology infrastructure and has consistently achieved exceptional operating metrics and returns.

Axis Finance has been investing in building a strong customer-focused franchise. The focus of our wholesale business continues to be wellrated companies and cash flowbacked transactions.

Key initiatives in fiscal 2023

Performance in fiscal 2023

Axis Capital Ltd

Axis Capital is one of India’s leading financial experts, providing customised solutions in investment banking and institutional equities. Using technology and our relationship-building power, we are committed to establishing a world-class franchise. Axis Capital has received consistent recognition as one of India’s best investment banks over the last two decades.

Axis Capital completed 18 ECM transactions in fiscal 2023, including 11 IPOs, 2 QIPs, 2 OFS and 1 Rights Issue. Marquee transactions included Biggest ever IPO in Indian capital markets, M&A transaction involving two of the biggest financial institutions in India, among others.

Key initiatives in fiscal 2023

Performance in fiscal 2023

*Source: Prime database; includes IPO, FPO, QIP, REIT, OFS and rights

Axis Asset Management Company Ltd

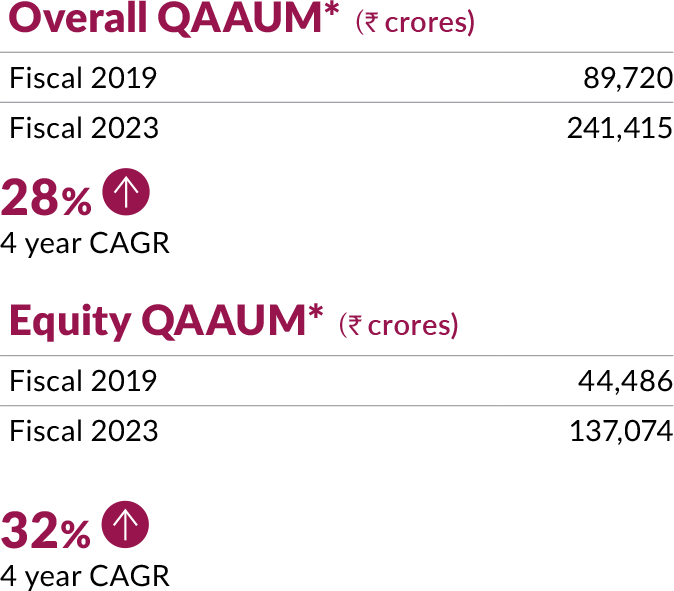

Axis AMC provides risk managed investment solutions to both retail and institutional investors across listed/unlisted equity, debt and real estate. We have a robust long-term performance track record, and we strive to emerge as the mostadmired asset manager. Through One Axis, the AMC’s partners have collaborated with the Bank to offer products like fixed deposits and credit cards.

Key initiatives in fiscal 2023

Performance in fiscal 2023

*Quarterly Average Assets Under Management

**Average Assets Under Management

Axis Securities Ltd

Axis Securities is a full-service retail brokerage focused on building an advisory model to acquire customers. We have deployed robust technology infrastructure and digital capabilities to deliver holistic solutions to our customers by leveraging One Axis environment. Investing consistently in product and service enhancements for an optimal customer experience is a top priority for us.

Key initiatives in fiscal 2023

Performance in fiscal 2023

Freecharge Payment Technologies Private Ltd

Freecharge has launched multiple new-age products targeted towards digitally native customers and merchants. It continues to evolve into a complete digital financial services platform, covering all verticals including savings, lending, investments, payments and insurance.

Key initiatives in fiscal 2023

Performance in fiscal 2023

A.TReDS Ltd

Invoicemart, India’s largest Trade Receivables Discounting System (TReDS) platform, is set up to resolve the credit challenges faced by MSMEs. TReDS is an electronic platform that allows a transparent and online trading of receivables. It is a digital marketplace which connects Buyers (CPSEs, State PSUs, Corporates) and MSMEs to an active pool of financiers, by way of a bidding process, thereby unlocking working capital for Buyers and their MSME suppliers, in a transparent and efficient manner.

Since its launch, the platform has scaled exponentially with the registration of more than 19,300+ MSME sellers, 1,300+ buyers and 56 financiers which is highest on any TReDS platform.

Progress so far (Jul-17 to Mar-23)

Axis Trustee Services Ltd

Axis Trustee Services is registered with SEBI and has been successfully handling various trusteeship activities, including debenture trustee, security trustee, security agent, lenders’ agent, trustee for securitisation and escrow agent, among others.

Max Life Insurance

Axis Group has a 12.99% share in Max Life Insurance, the fourth largest private insurance company.

Axis Pension Fund Management (PFM) Ltd

Axis PFM commenced its operations effective October 21, 2022, to manage pension funds for investors across all retirement product categories and provide the best retirement solutions to customers. Since then, it has steadily gained total number of subscribers as well as total ‘AUM’. Despite being the last among three new entrants, PFM has shown remarkable performance for NPS (National Pension Scheme).

Capitalising on the One Axis approach, Axis Bank became the fastest private Pension Fund to cross ₹100 crores of AUM after being incorporated in fiscal 2023.