Deliver world-class customer experience

Leadership in digital and technology

Build India’s most profitable Bharat Banking franchise

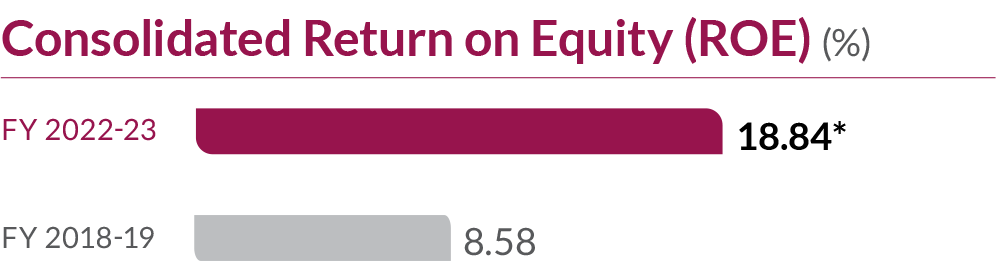

*Excluding exceptional items

*Excluding exceptional items

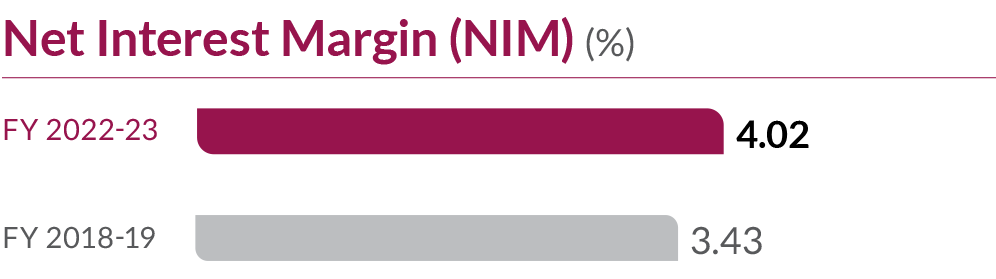

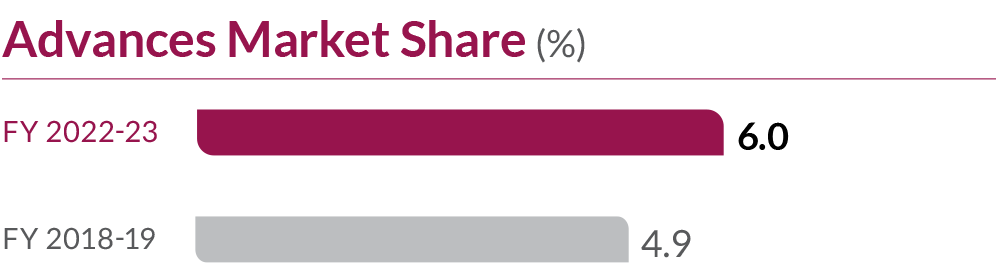

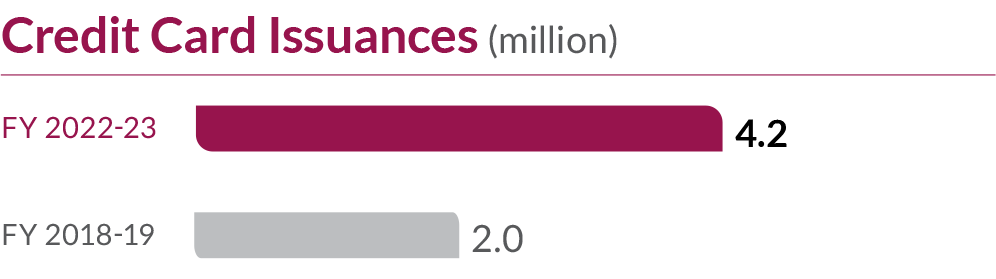

#Compounded Annual Growth Rate (CAGR) for fiscal 2023 over fiscal 2019 period as compared to CAGR during fiscal 2016 to fiscal 2019

Exceptional items comprise (i) full amortisation of Intangibles and Goodwill amounting to `11,949 crores; (ii) impact of policy harmonisation of operating expenses and provisions amounting to `361 crores; and (iii) one-time acquisition related expenses amounting to `179 crores; on account of acquisition of Citibank India Consumer Business. Bank has fully charged to the profit and loss account all the exceptional items in fiscal 2023. The cumulative impact of all the exceptional items on Bank’s profit and loss account (net of taxes) is `12,354 crores. (Refer note 18.1 of Standalone and Consolidated financial statements)

Above are standalone figures as on/for year ended March 31, 2023 unless otherwise mentioned

For customers, trust and preferences are based on the quality, responsiveness, and consistency of their experiences. We have empowered our employees to deliver customer delight through human touch aided by technology. Tools like Sparsh and Siddhi enable Axis employees to engage with customers seamlessly in a boundaryless world, thereby building stronger long-term relationships.

Read more

We have a bold vision to underwrite every Indian by the year 2030. With Axis 2.0, our Digital Retail Bank, and with NEO, our best-in-class Digital Corporate Bank, we are building alternate data platforms and capabilities to underwrite a significant section of the lendable population, be it salaried or self-employed. Our robust suite of digital banking solutions will be a powerful engine that propels us towards market leadership.

Read more

We continue to build our offline distribution through our expansion in rural and semi-urban markets under Bharat Banking. In addition, we are ramping up our digital capabilities to expand our reach through multiple channels. Our banking solutions are easily accessible to millions of customers at any place and all the time.

Read more

In today's integrated and co-dependent world, partnerships play an important role in expanding the scope and accelerating business benefits. We have expanded our customer base, improved product propositions, increased geographical reach, enhanced capabilities, and improved our time to market through our partnerships. The partnerships have helped us explore synergies and offer distinctive solutions to our customers thus facilitating a connect and grow approach.

Read more

We aspire to be the #1 employer in the Indian financial services space. Our inclusive hiring efforts cover women including homemakers, people belonging to the LGBTQIA+ community as well as persons with disability (PwD). We focus on building a fair and performance-driven culture, where skills get as much importance as education. The seamless integration of Citibank India Consumer Business employees is a testimony to the importance we place on our people.

Read more

Under the One Axis umbrella, the group offers a universal banking platform catering to diverse business segments. Our products and services are integrated to provide a wide range of value propositions for our customers across the board. We are committed to strengthening our relationships with customers in the long-term by offering tailored solutions for their financial needs.

Read more