Seamless onboarding

Best-in-class DIY onboarding with a fully digital journey

We use cookies to improve your journey and to personalize your web experience. By continuing to use this site, you are accepting the bank’s cookie policy. I Accept

Fixed Deposits Open FD

Domestic Fixed Deposits

(1Yr 11 days to 1Yr 24 days)

Less than 2Cr

2Cr to Less than 5Cr

(2Yr < 30Mts)

Less than 2Cr

2Cr to Less than 5Cr

(1Yr 11 days to 1Yr 24 days)

Less than 2Cr

2Cr to Less than 5Cr

(2Yr < 30Mts)

Less than 2Cr

2Cr to Less than 5Cr

(1Yr 11 days to 1Yr 24 days)

Less than 2Cr

2Cr to Less than 5Cr

(2Yr < 30Mts)

Less than 2Cr

2Cr to Less than 5Cr

Loans

Get your Full Power Digital Current Account with just PAN + Aadhaar + Video KYC

Get your Full Power Digital Liberty Current account for Sole Proprietorship firm with just PAN + Aadhar + GST + Udyam + Video KYC

Account specifically meant for Retailers

Account best suited for Large Retailers & Wholesalers

Account specifically meant for Traders and Wholesalers

Account specifically meant for Manufacturers and Distributors

Best suited for Large Firms and Mid-Corporates

Best suited for Large Distributors, Manufacturers & Service Providers

Best suited for Large Corporates and MNC's

Account specifically meant for Jewellers

Account specifically meant for Trusts and Societies

Account best suited for Arthiyas / Commission agents of Farm Mandis / APMCs

Account specifically meant for Trade & Forex customers and Importers & Exporters

Account best suited for new-age startup

Collect cash or cheque via multiple touch points of bank

Facilitates validated collection via multiple online modes and 4500+ Branches

Mandate Based Collections (digital & physical form based) at an agreed frequency

e-Collection of funds with validations

Compact and easy to use machine for accepting payments

"Tap & Pay" contactless payment terminals

Smart machines with in-built 4G, WiFi & bluetooth connectivity

QR code based payment solution

Accept any debit/credit card payment through a mobile device

Billing and Inventory management using your PC

Services such as EMI, SI & more

Accept instant payments with just a scan of a QR code

Quick itemized billing with Android Smart POS

Guaranteed payment in a specified currency to the Exporter

Payment mode for International Trade through financial/commercial documents

Advance Payment to seller before shipment of goods

Short-term working capital Trade Credit loan

Facility of arranging funds for Importers using LC

Trade Credit structure by the reimbursing bank on the basis of LC

Solution to simplify collection of export proceeds

Solution meeting your pre-shipment finance requirements

Purchase/Discounting of Export bills

Negotiation of LC backed bills and availment of finance before the due date

Authenticate and forward LC to the beneficiary

Add confirmation to LCs issued by foreign Banks and give a definite undertaking of payment of LC

Export credit at competitive terms and conditions for Small and Medium sector Exporters

Digital platform to transact majority of Import-Export transactions online

Digital offering allowing you to settle Inward remittances online

End to end digital journey for Import bill payments

End to end digital journey for Export bill regularization

Platform to manage the entire Software export journey digitally

Opt for alerts and notifications of your trade transactions

Enables Dealers/Distributors/Channel Partners of Corporates to avail extended credit periods to finance their purchases from Corporates

Leverage Corporate relationships to unlock working capital for vendors by providing them finance against their sales to Corporates

Structured solutions facilitate quick conversion of supplier receivables to cash and allows them to deploy cash in their core business

Inland LC issuance to facilitate purchase of goods

Discounting Inland Bills for immediate release of funds against trade receivables

Negotiation of LC backed bills and availment of finance before the due date

Services for timely receipt of payments and delivery of documents against acceptance

Hassel Free loans to help you achieve your professional needs

Boost your business with collateral free loans

One stop cash flow support for your operational needs

Loan facility for Merchants to fulfill the business requirements

Loans to support all your commercial & long-term needs

An unsecured overdraft facility for your business requirements

Customized product offerings including WC Finance, Term loans, Trade products

Hassle-free property backed overdraft for meeting all business needs

Provide a boost of liquidity to your business through easy-to-use quick overdraft facilities

Boost your firm’s liquidity with hassle-free quick bills discounting

Avail loans without locking-in your assets

Knowledge series for SMEs

Understanding MSME and Policies around it

Service Charges for LC / MC / SME / Agri (Corp) / MFI Borrowal Accounts

focused approach to ensure flow of credit to the MSE sector

Policy on framework for revival and rehabilitation of micro, small and medium enterprises (MSMEs)

MSME specific campaigns

MSME policies, debt restructuring policy and other information on policies

Forex Risk Management services

Forex Management products and services including Trade Finance & Advisory and Hedging solutions

Meet your working capital requirement through cost effective Foreign Currency Demand loans (FCDL) and Foreign Currency Term loans (FCTL)

Rates offered to Corporates for FCY currencies

Investment opportunities in Treasury bills (T-Bills)

Online solutions for purchase & trade in GOI securities (G-Sec)

Raise short-term money via Commercial Papers (CP)

Trade in call linked products either as lenders or borrowers

Purchase and trade in Certificates of Deposits (CDs)

Hedging solutions for Interest Rate Risk

Shift your interest or principal (or both) liability from one currency to another.

Hedging solutions for your balance sheet

Avail interest rate risk management and currency hedging solutions

Hedge credit risk arising out of lending

Exchange a currency pair at a pre-decided rate

Avail clearing and settlement services and various funding facilities to Brokers

Range of debt solutions to meet your specific requirement

Specialized Capital Fund products offerings across wide array of Corporate requirements.

FI, ODIs, ECBs and more

Demat & Custodial Services for Institutional Investor

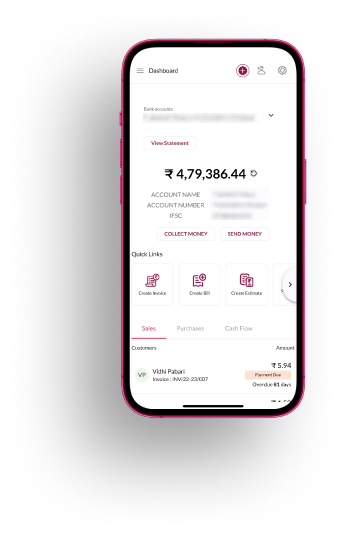

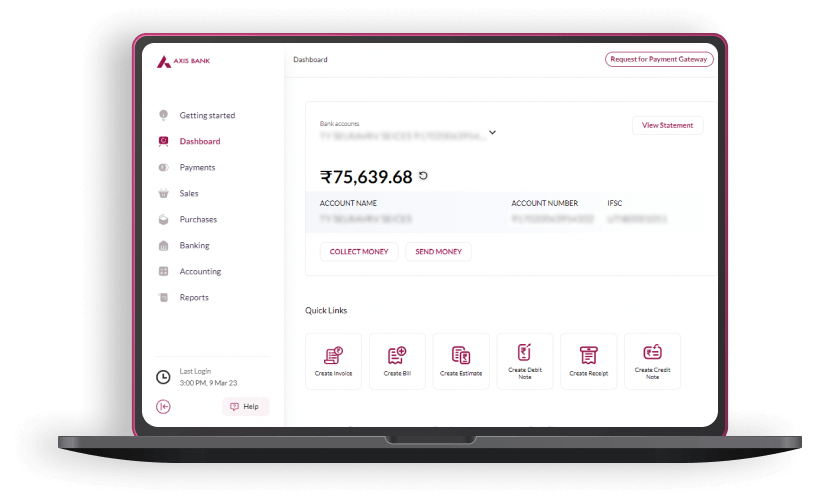

A banking and beyond banking platform for MSMEs

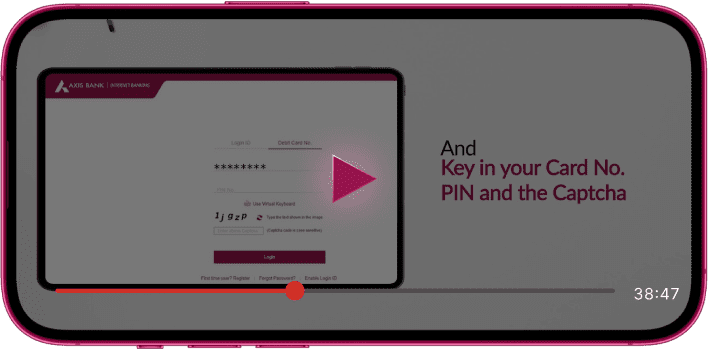

Carry out online business transactions from the comfort of your home or office

Track the daily business banking transactions on the move

Web-based online trade portal for Trade Finance transactions

Undertake Forex transactions and track Forex markets in real time

Payment facility for Goods and Service Tax

Path breaking digital banking platform that delivers highly customized solutions for you.

A banking and beyond banking platform for MSMEs

An exclusive application to execute daily transactions at your convenience

Platform for trading and booking online deals while tracking live forex markets

Make payments just by scanning QR codes at merchant outlets and on bills

Fulfill your banking needs at anytime via SMS

For Sole Props and Individuals with CANew

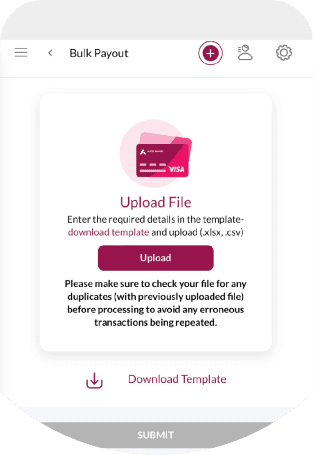

Send single and bulk pay-outs to the vendors with easy tracking

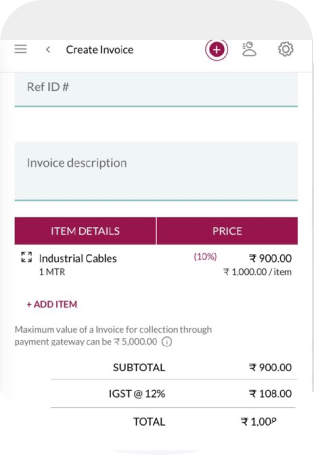

Create GST compliant invoices with multiple payment options and experience flexible reconciliations

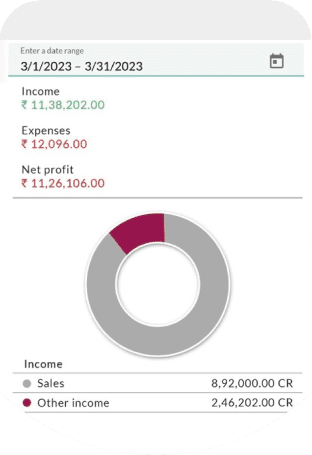

Built-in automated financial reports and a real-time business analysis.

Download the app and Experience "Grow your business"

Get your fully active Current Account in under 24 hours opened end to end digitally from comfort of your home or office

*Applicable for Sole props only.

Best-in-class DIY onboarding with a fully digital journey

A fast and easy personalized business profile set-up

Add bulk beneficiaries and make a single payment to all

Catalogue and manage your business inventory

Experience the new age business banking designed to accelerate your business growth

Experience instant invoicing, flexible reconciliations, and much more.

Extensive audit trail and internal controls

Built-in accounting of GST

Instant invoicing and auto matching

Auto categorize income and expenditure

Real-time business analyses with customizable P&L and much more to stay a top your business

neo for business is an all-in-one platform for banking & beyond banking business needs of MSME customers. It aims to offer a truly seamless business banking experience by combining everything from banking to invoicing, bulk payments, payment gateway, expenses & automated bookkeeping

An individual or sole proprietor, holding a Current Account with Axis Bank can register on the platform. A user who does not have a Current Account with Axis Bank can sign up as a guest user to explore and view the features available on the platform. However, to enjoy the full benefits of the platform, you need to open a Current Account with Axis Bank

No. Axis Bank does not charge a fee for using neo for business. Your telecom operator may charge for the use of data (internet browsing) or for SMS service on your mobile device.

As a ‘Guest User’, you can open a Current Account instantly with video KYC

Yes, neo for business is completely secure, with end-to-end encryption and 2 factor authorisation using OTP on your registered mobile number, to ensure all your transactions are protected.

The below services will be available on neo for business very soon. In the meanwhile, please use Retail Internet Banking/Retail Mobile Banking to access the same.

1. Current Account servicing such as address update, cheque book

servicing, debit card servicing etc.

2. Bharat Bill Payment Services

3. Book and Liquidate FD

The added beneficiary should have completed the cooling period timeline of 30 mins. Post that there is a transaction value limit of INR 50,000 for first 24 hours.

You can use the payout link to make payouts up to INR 50,000 and

avoid the cooling period restrictions.

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the "Accept" button, you will be accessing a website operated by a third party namely . Such links are provided only for the convenience of the client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axisbank.com in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axisbank.com

At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further.

This is to inform you that by clicking on the hyper-link/ok, you will be accessing a website operated by a third party namely Such links are provided only for the convenience of the Client and Axis Bank does not control or endorse such websites, and is not responsible for their contents. The use of such websites would be subject to the terms and conditions of usage as stipulated in such websites and would take precedence over the terms and conditions of usage of www.axisbank.com in case of conflict between them. Any actions taken or obligations created voluntarily by the person(s) accessing such web sites shall be directly between such person and the owner of such websites and Axis Bank shall not be responsible directly or indirectly for such action so taken. Thank you for visiting www.axisbank.com

Cover arranged by Axis Bank for its customers under Digit Illness Group Insurance Policy (UIN GODHLGP20142V011920). Participation to group insurance is voluntary.

Please select one of the below options to proceed

Retail Internet Banking Corporate Internet Banking Redirection link