- Home

- Business Banking

- Collection Solutions

Collections Solutions

We understand your business is unique and to support growth and drive efficiency, Axis Bank offers wide range of Cash Management Services to manage your collections and payments.

With Axis Bank's widespread presence and on-ground support across the country, you can streamline your business operations through technology enabled tailor made solutions.

3000+ CMS enabled branches and 1800 locations for cheque and cash collections and advanced electronic collection solutions will assist you in taking your business to the next level.

Features and Benefits:

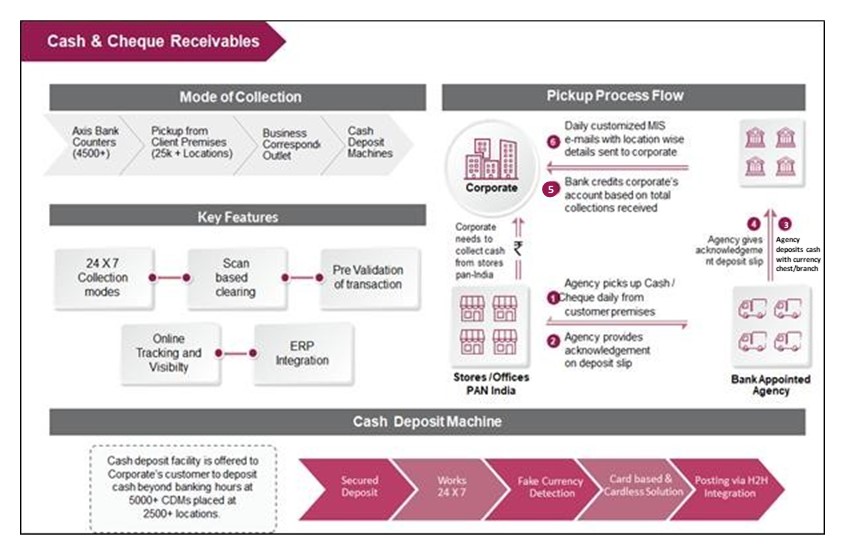

PAN India pick up capability, cash & cheque deposit at nearest branch/centers, same day credit, and customized reports for collections to efficiently manage the receivables.

How it works:

Eligibility and Documentation:

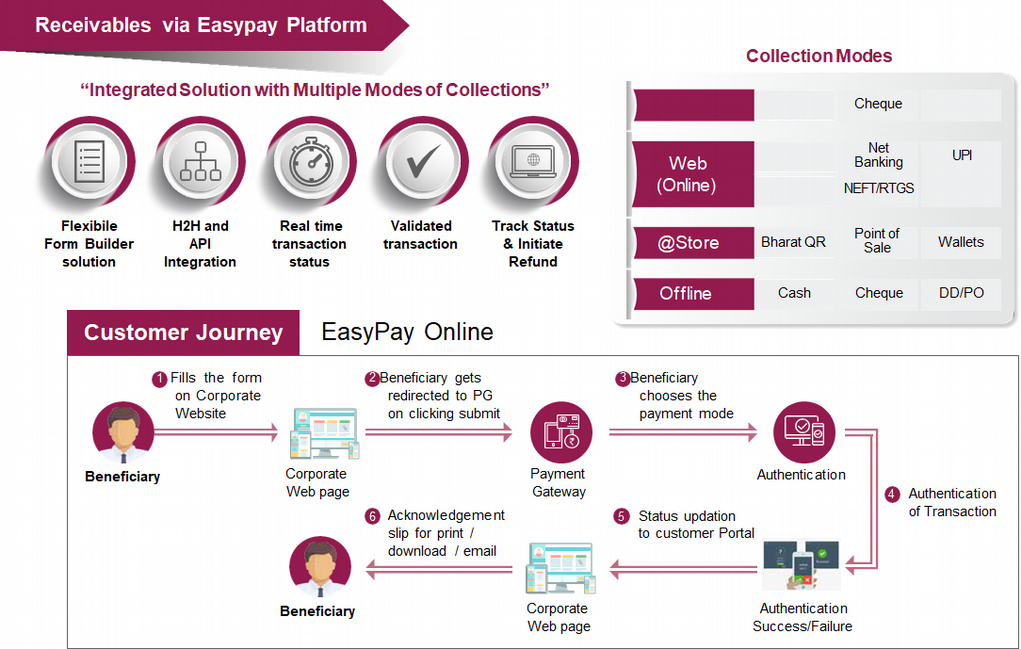

Easy Pay Online offers collections through Credit card/Debit card/Net banking/ Rupay Card/UPI/BharatQR/POS/eWallet. Collection solution for schools, colleges, educational institution, dealer-distributor collection, e-commerce platform solutions can be streamlined and automated through Easy Pay.

Easypay Branch provides a complete integrated solution for enabling cash and cheque collections at Axis Bank branches with capabilities like online validation over web service connectivity and real time transaction update.

Features and Benefits:

1.Easy integration, rapid hassle-free enablement of payment acceptance

2.Fast transaction-processing speed and Real time access to data.

How it works:

Eligibility and Documentation:

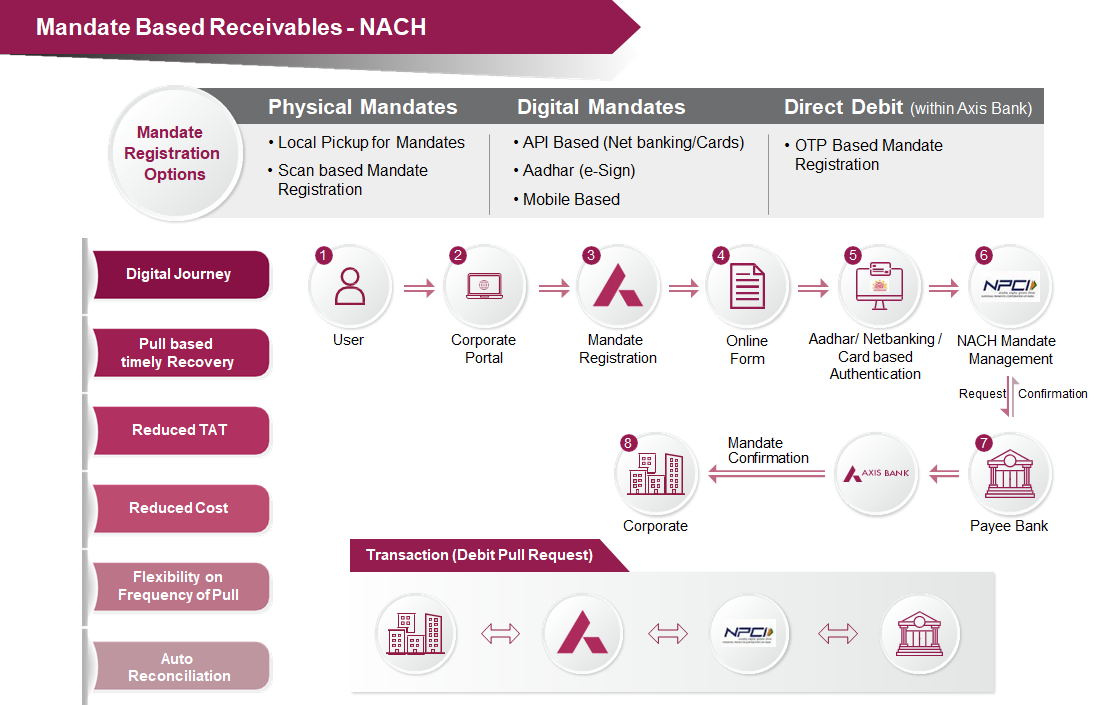

NACH Mandate based collection to pull funds at required frequency. This solution gives control to the clients to pull funds from dealers/buyers. Registration of NACH mandates, transmission of debit instructions and returns management can be fully integrated.

Features and Benefits:

a) Integrated mandate management & transaction initiation solution.

b) Mandate collection from clients premises and scan based processing.

C) Real time customized MIS.

How it works:

Eligibility and Documentation:

The solution enables identification of remitter information for all mode of payments. Inward transactions to virtual accounts (domestic and foreign transactions) will assist in segregating cash flow at a different business units or at a product line level.

Features and Benefits:

Credit to multiple accounts, credit validation of transactions, customized reverse feed via multiple channels.

Eligibility and documentation:

Other Collection Solution Services

In-store Payment Acceptance

Internet Payment Gateway

BBPS

E-Collections for Govt. bodies/ Agencies

Apply

Now

Apply

Now