As we reflect on three decades of banking excellence, we take pride in our rich legacy of leadership, nation-building, customer centricity, and community service. Our success stems from our unique and differentiated approach to banking, embodied in our ethos of ‘dil se open’. This commitment to openness sets us apart as a preferred banking partner.

By continuing to embrace innovation, promoting economic empowerment, and driving positive transformation, we are leading change in the sector and beyond. This is exemplified by our class-leading technology stack, powering innovations like the ‘open’ by Axis Bank app that has revolutionised banking through ease and accessibility. In the years ahead, we will continue to lead the change with our openness to innovation, inclusivity and sustainable growth.

The standalone financial statements of the Bank (‘financial statements’) have been prepared and presented under the historical cost convention on the accrual basis of accounting in accordance with the generally accepted accounting principles in India, unless otherwise stated by the Reserve Bank of India (‘RBI’).

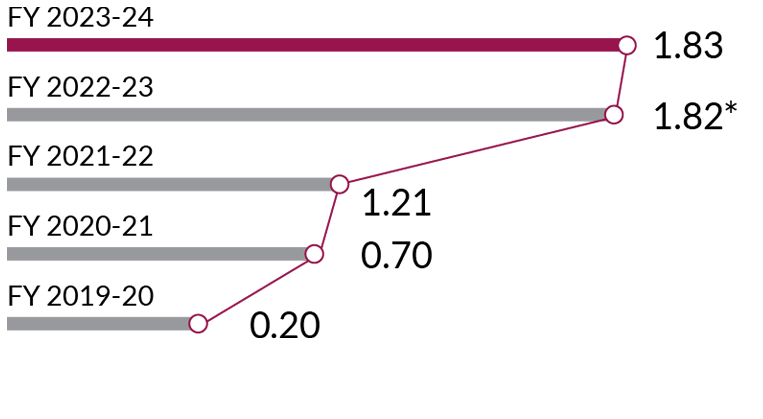

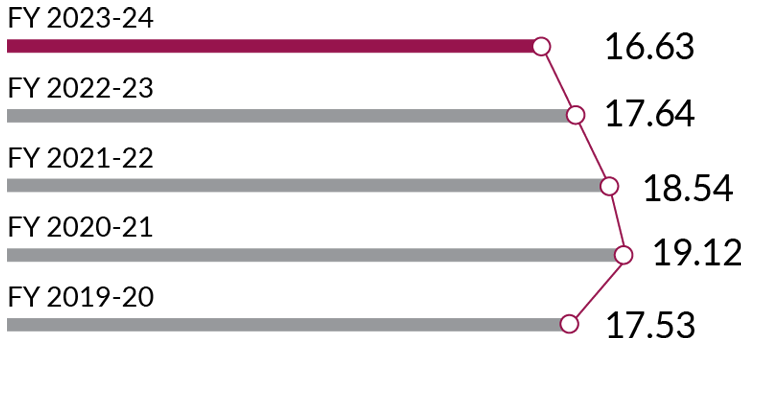

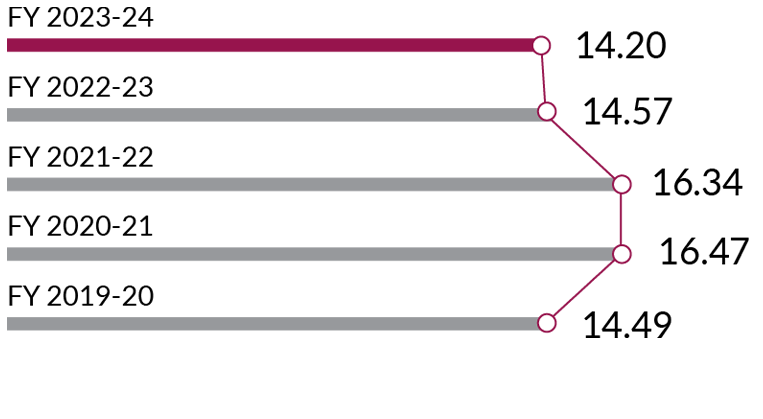

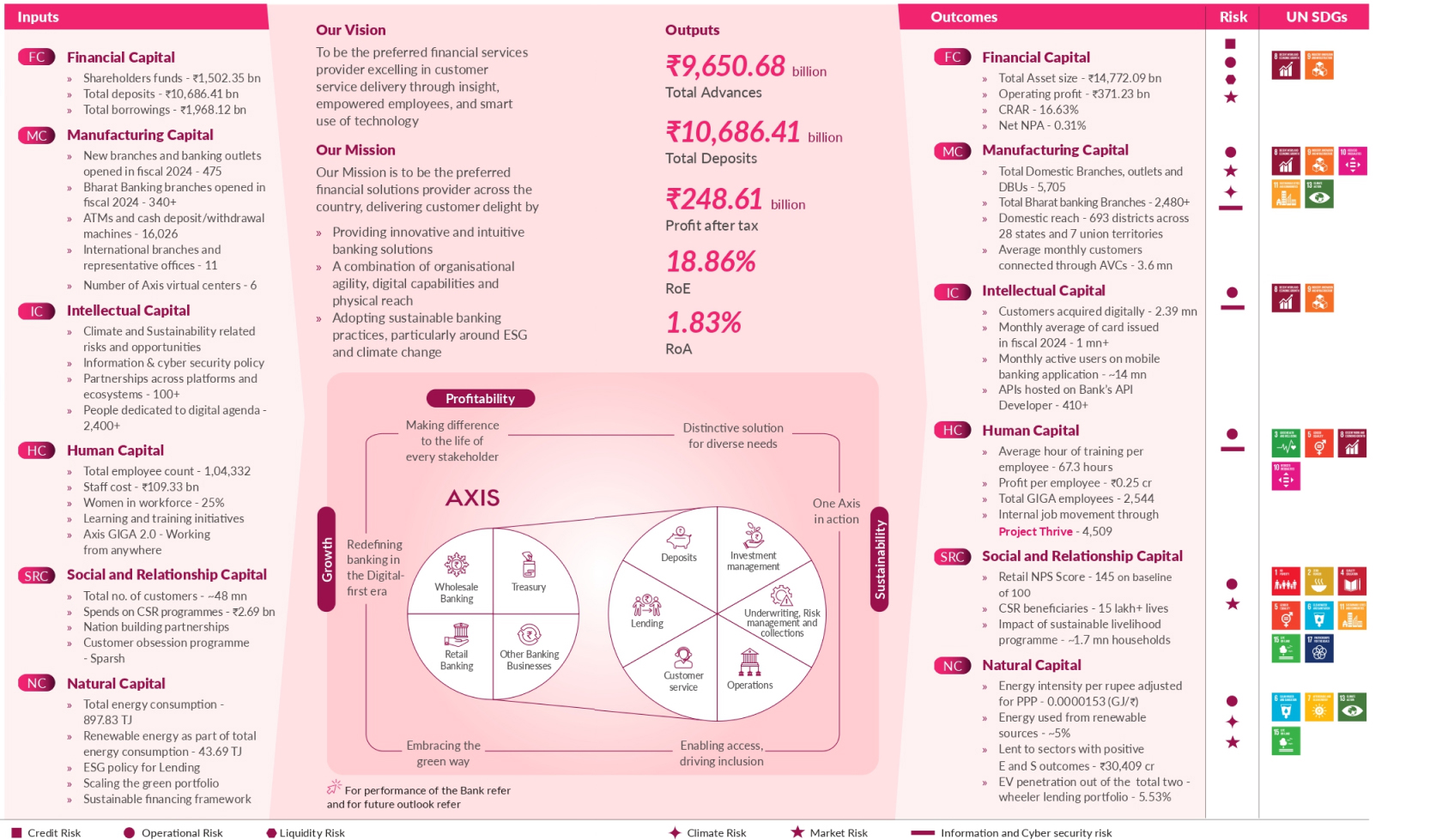

Our Financial capital represents the resources we utilise within the business processes to generate sustainable outcomes for all our stakeholders.

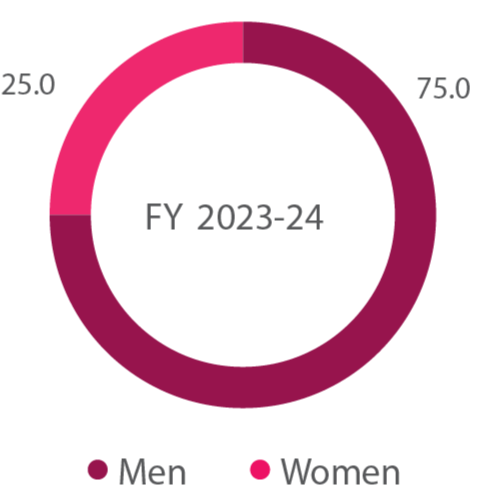

Our Human capital comprises our skilled and diverse workforce, united in their dedication to driving organisational growth through collaboration and innovation.

Our Intellectual capital encompasses our collective knowledge and skills as well as the digital capabilities of the Bank, fueling customercentric initiatives, data analytics, and automation while prioritising customer data privacy.

Our Manufactured capital encompasses the range of products and services we offer through our business segments and our branch network.

Our Social and Relationship capital comprises of the relationships we nurture with our stakeholders including the community as a whole to foster inclusive development.

Our Natural capital embodies the vital resources harvested from our ecosystem, such as energy, water, and materials, which sustain our business operations.

At Axis Bank, we believe in embracing new opportunities and paving the way for sustainable growth. Our diversified and integrated banking model is designed to combine financial strength, trust, and innovation, creating new possibilities for our customers, employees, and communities to achieve their aspirations.

Providing innovative and intuitive banking solutions

A combination of organisational agility, digital capabilities and physical reach

Adopting sustainable banking practices, particularly around ESG and climate change

Over the course of the past few years, our GPS strategy, centred on customers and people, has set us on the path of predictable and sustained high performance.

We have strengthened our ‘House of GPS’ with distinctiveness and identified focus themes to take charge

Bolstered the Sustainability elements with focus on Executional Excellence, People Proposition, and Operational Risk and Compliance

Our retail franchise is focused on deepening our connection with individuals, small businesses and Bharat Banking customers by offering innovative products and transformation initiatives through our branches and mobile app.

* consists of deposits and assets under advice

Loans, savings and retail term deposits, credit, debit and forex cards, bill payment services, wealth management and third-party product distribution such as life and non-life insurance, mutual funds, government bonds, etc.

We meet the banking needs of Indian corporates and MSMEs, leveraging our strong value proposition in transaction banking and digital transformation.

Loans, current and corporate term deposits, payments, trade finance products, letter of credit, bank guarantees, foreign exchange, derivatives, cash management services and commercial cards.

Under the ‘One Axis’ umbrella, we provide comprehensive products and solutions through our business segments and subsidiaries.

Above are standalone figures as on/for year ended March 31, 2024 unless otherwise mentioned

Investments, broking, asset management, insurance, MSME digital invoice discounting platform, trustee services and payments in addition to the services provided by banking segments.

Our customers are at the heart of everything we do. Our extensive network of branches and ATMs enables us to stay closer to them,

while our advanced digital reach enhances our accessibility, facilitating seamless banking experiences anytime, anywhere.

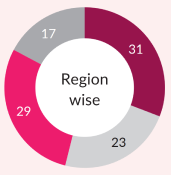

Branch Profile (%)

Dear Shareholders,

It gives me immense pleasure to present to you the Bank’s first-ever Integrated Annual Report for the financial year 2023-24. As I write my inaugural letter to the shareholders, I feel delighted and privileged to have joined the esteemed Board of Axis Bank in a year that marked its 30th year of unwavering service and commitment to the stakeholders.

N. S. Vishwanathan

Independent Director and Part-Time Chairman

Download This Section

Dear Shareholders,

Fiscal 2024 was a momentous year for us in many ways. As we celebrated the 30th year of unwavering ‘dil se open’ service to our customers, we had yet another strong year of performance built on our GPS strategy. We are now consistently surpassing our aspirational return ratios with better quality and consistency of earnings, while maintaining a strong balance sheet position.

Amitabh Chaudhry

Managing Director and Chief Executive Officer

Download This Section

The Retail Banking segment continues to be the mainstay of the Bank’s GPS strategy as we delivered yet another year of strong growth. During the year, we made significant progress in our journey to create one of the best premium Retail Banking franchises, with improvement in the quality of our deposit franchise and sustained momentum in our Retail loan book.

Munish Sharda

Executive Director (Retail Banking)

Arjun Chowdhry

Group Executive (Affluent Banking, NRI, Cards and Payments)

Sumit Bali

Group Executive (Retail Lending and Payments)

Fiscal 2024 was yet another significant year for the Bank as we took big strides in our journey to become the Operational Banker of Choice for Corporate India. In line with our stated strategy, we continued focusing on relationship RAROC-led approach and offering innovative holistic solutions to deliver profitable and sustainable growth.

Rajiv Anand

Deputy Managing Director

Download This Section

Dear Shareholders,

Fiscal 2024 has been a remarkable year in our journey towards becoming an all-weather franchise. In line with our GPS strategy, we maintained our growth momentum and profitability while also strengthening and transforming the core of the Bank.

Subrat Mohanty

Executive Director (Banking Operations & Transformation)

Download This Section

Our commitment to value creation is anchored in decisions that prioritise stakeholder interests, fortified by a robust ESG strategy and exemplary governance practices. Guided by our overarching purpose of fostering positive economic, social, and environmental impact, we aim to ensure that every action we take contributes to a sustainable future. In fiscal 2024, we continued to progress on our ESG journey, contributing to the national and international dialogue on sustainable development and climate action.

Download This Section

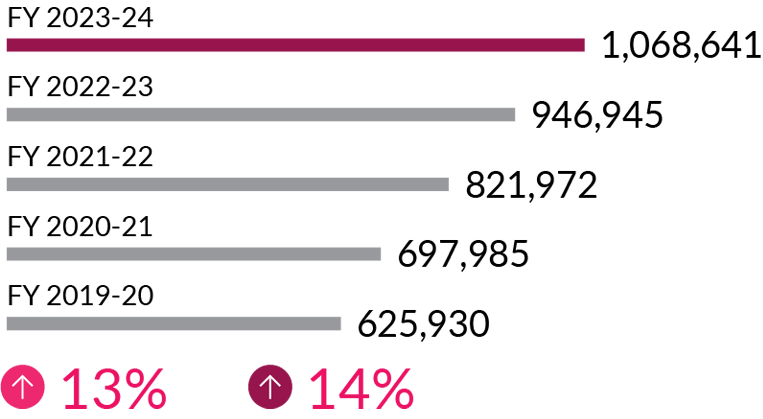

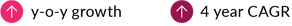

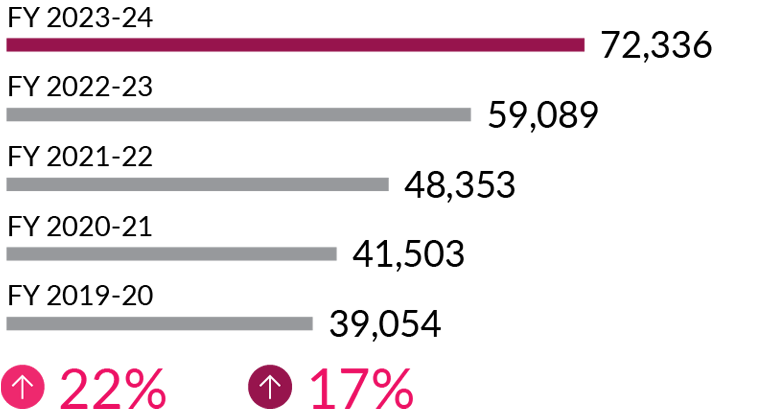

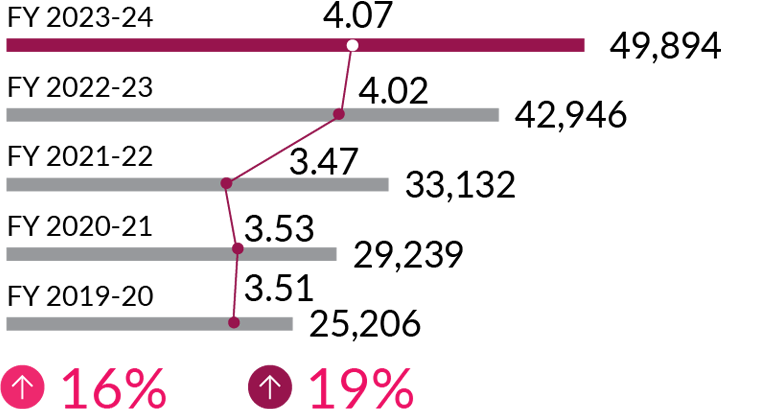

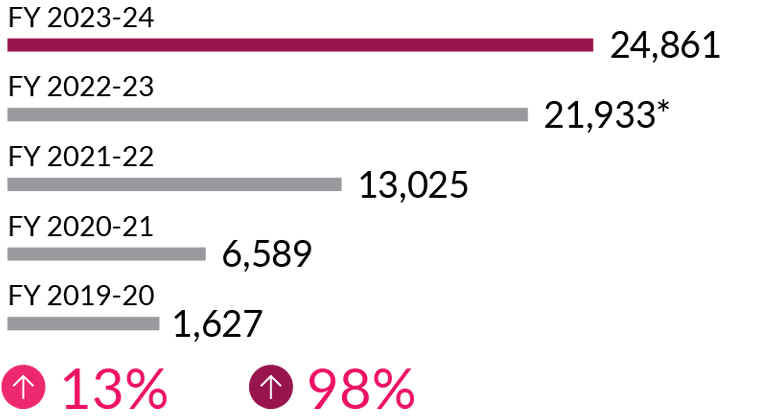

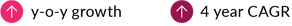

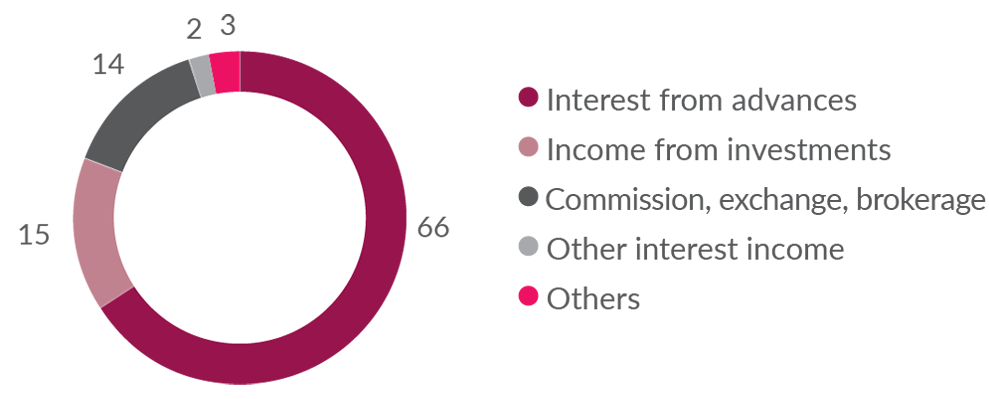

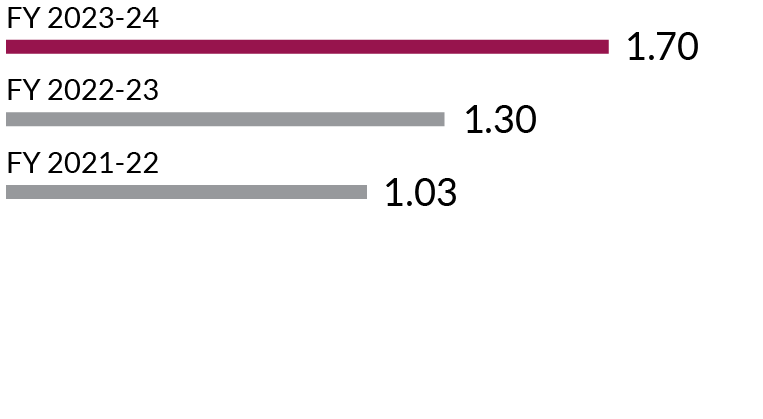

Our alignment with the GPS strategy and transformational projects have resulted in a strong operating performance in fiscal 2024, evident from a 16% y-o-y increase in operating profit and a 16% y-o-y growth in net interest income. We remain well-capitalised to seize future growth opportunities, and our customer centricity and strategic banking approach of sector-specific portfolio diversification enable us to identify opportunities and manage our risks effectively.

Download This Section

Balance Sheet

Profit and Loss

*Excluding exceptional items

Key Ratios

*Excluding exceptional items

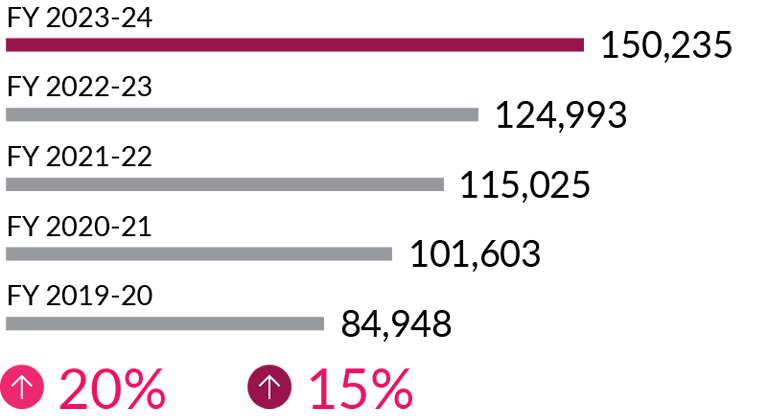

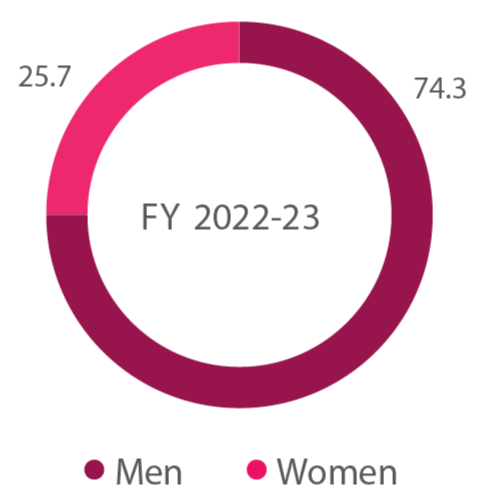

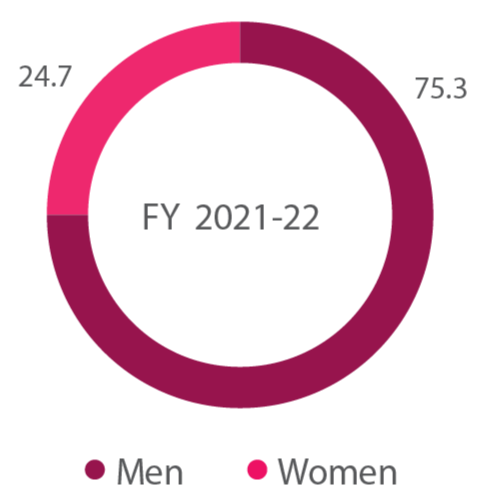

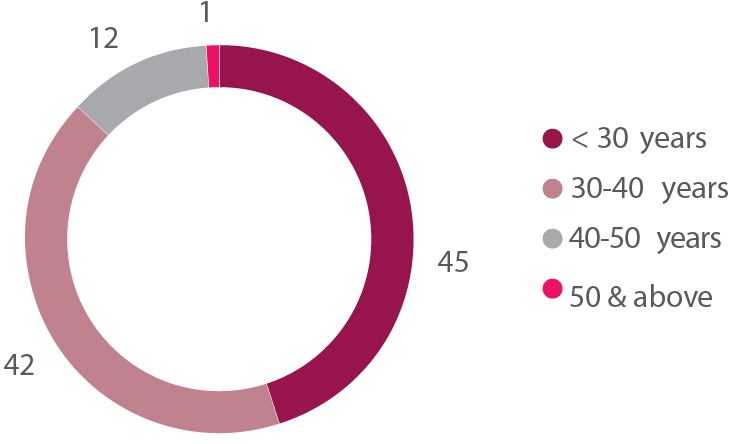

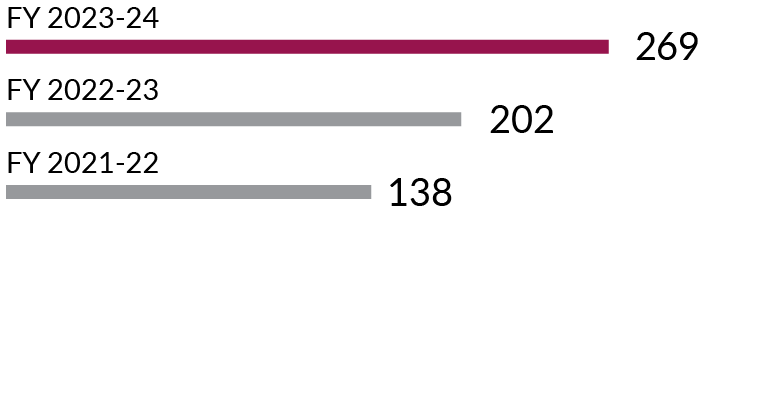

People

Community

*Includes amount transferred to Unspent CSR accounts to be utilised in ongoing programmes in subsequent years

#Under the Sustainable Livelihoods Programme

Above are standalone figures as on/for year ended March 31, 2024 unless otherwise mentioned

Our strategic pillars give us manoeuvrability in a dynamic landscape where banking has long transcended its traditional boundaries. From tailoring distinctive solutions for varied needs to redefining banking in the digital-first era, our focus remains on enabling access, driving inclusion, and embracing sustainability.

Download This SectionThe One Axis ecosystem is at the heart of the distinctiveness that we offer. Within the framework of One Axis, our group operates a versatile banking platform designed to cater to various business segments.

In the digital-first era, our pioneering initiatives like ‘open’ by Axis and ‘NEO’ are catalysing transformative change, redefining banking experiences for customers.

Our Bharat Banking initiative is a key strategic priority aimed at integrating rural and semi-urban India (RuSu) into the economic fabric while addressing their diverse financial needs.

The Bank’s commitment to customer centricity and innovation is evident in our distinctive solutions, which propel pivotal outcomes.

We believe in our purpose of creating thriving communities. We prioritise genuine care for our customers, employees, and the broader community.

Embracing the green way has positioned us as leaders in environmentally conscious banking, catalysing positive change within our institution and throughout the broader economy.

One of the fastestgrowing MF player

Leadership position in ECM deals segment

AAA rated NBFC with diversified product offerings

3rd largest Bank led brokerage firm

Amongst the leading trustees in India

One of the major fintech players in India

Leading player on TReDS platform

5th rank in terms of subscriber addition since inception

4th largest private insurance company (Co-promoter)

Capitals Impacted

SDGs Impacted

Capitals Impacted

SDGs Impacted

Capitals Impacted

SDGs Impacted

Capitals Impacted

SDGs Impacted

Capitals Impacted

SDGs Impacted

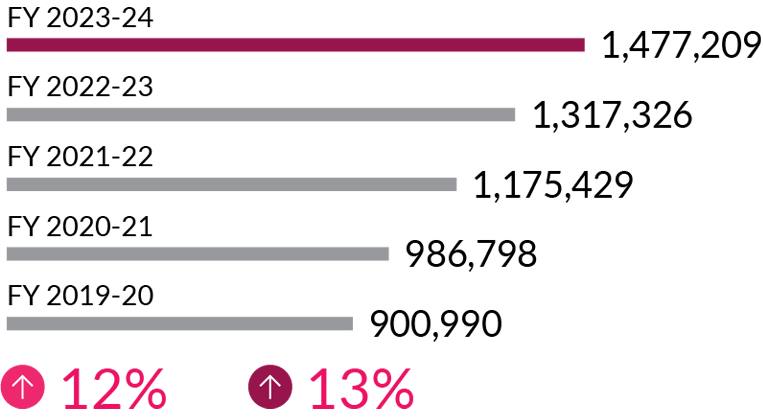

Supported by continued growth in consumer spending, innovative payment products, synergies with the acquired Citibank business, and improved resource mobilisation, Retail Banking was able to sustain a strong growth momentum

Capitals Impacted

SDGs Impacted

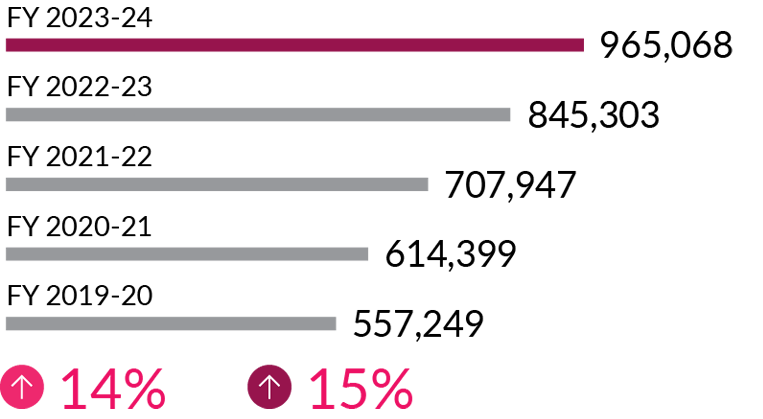

Our Wholesale Banking business prioritises client-centricity, aiming to deliver unparalleled service through a robust organisational structure and market leadership. An extensive physical reach and digital offerings are ensuring greater access as well as a seamless banking experience to our customers.

Capitals Impacted

SDGs Impacted

Our approach to value creation is driven by decisions that consider stakeholder interests and are supported by a robust ESG strategy and best-in-class governance practices. Everything we do aligns with our overarching purpose of generating positive economic, social, and environmental impact.

Download This Section

Our strong governance practices help us uphold the best interests of our stakeholders, foster a culture of accountability, build relationships of trust, and confidence with our customers and future-proof our business by managing risks effectively

Download This Section

We abide by exemplary standards of corporate governance and best practices. Our primary objective is to uphold the long-term interests of our shareholders through robust policy frameworks and prudent risk management practices.

Board Expertise

Board Skills and Experience*

Policies and Frameworks

Subsidiary Governance

ESG Governance

Fraud Risk Management and Reporting

Combating Financing of Terrorism (CFT)

We remain agile and responsive to risks from a challenging environment globally and the opportunities provided by a strong and resilient Indian economy. We have raised our compliance thresholds so that we secure the best interests of our stakeholders and customers, even as we aim for industry-beating growth.

Global Economic Outlook

Technology Evolution and Artificial Intelligence

Climate Resilience and ESG Integration

Cyber Security Threat and Customer Privacy

Transforming Talent and Workplaces

Regulatory Landscape

We have a robust and comprehensive Risk Management Framework to strengthen our capacity to recognise and address risks. Backed by an independent risk function, the Board oversees all facets of risk management.

Risk Governance Framework

Risk Management Approach

Fraud Detection and Mitigation

Managing our Climate Risk

We prioritise cyber security and safeguard our customers against unauthorised access and cyber threats through robust security controls, including proactive detection and monitoring technologies. Apart from modernising our core technology stack for better performance and resilience, we are also developing new age digital platforms.

Cyber Security Governance Framework

Measures for Proactive Detection of Cyber Threats

Steps to Strengthen Enterprise Architecture in Fiscal 2024

Achievements in Digital and Cyber Security space

Thought leadership and policy advocacy play pivotal roles in shaping industry trajectories and fostering sustainable growth. At Axis Bank, we embrace the responsibility to drive meaningful discourse and advocate for policies that catalyse innovation, inclusivity, and resilience within the financial ecosystem.

Alliance with Key National and Global Associations

Key submissions made to various associations

Our Board features a diverse group of industry leaders who inter alia bring a wealth of experience in banking, finance, information technology, human resources, business management etc. Their combined expertise guides our strategic vision, ensuring both growth and adherence to the highest standards of corporate integrity.

Download This SectionBringing their diverse expertise in finance, risk management, and operations, our Core Management Team oversees key banking functions, and steers the Bank through economic cycles, technological advancements, and regulatory changes. With a sustained focus on integrity, transparency, and customer centricity, the team upholds the Bank’s commitment to excellence and towards creating stakeholder value.

Download This SectionWe lead the change by demonstrating our proactive approach towards critical global issues, be it the lack of financial access or the challenge of climate change. Our

commitment to advance financial inclusion and social equity, environmental stewardship and sustainable practices, set a benchmark for responsible banking, showing

our leadership in creating a better future for both people and the planet.