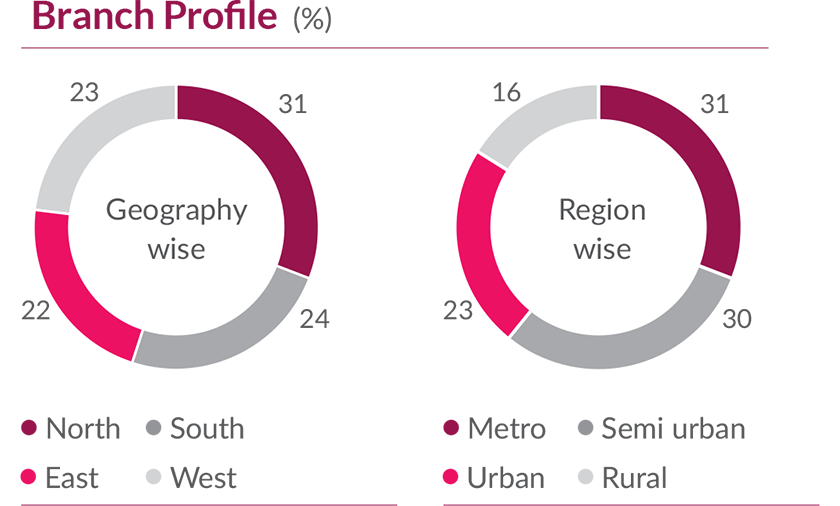

Our branch network is well-distributed across the urban, 'rural, and semi-urban' (RuSu) regions of India. During the year, we added 145 branches to our network and we adopted a calibrated approach towards our network expansion, with focus on improving productivity across our channels. Our RuSu branches align with our Bharat Banking strategy and follow an asset-led liability model, while our Platinum branches cater to our Small Banking Business (SBB) customers.

We have an international presence through branches in DIFC (Dubai) and Singapore, representative offices in Bangladesh (Dhaka) and the UAE (Abu Dhabi, Dubai and Sharjah) and an offshore banking unit in GIFT City.

We aim to be a world-class digital bank and have invested in digital banking services to provide an enriching experience and engagement through innovative and secure channels. The Axis Mobile app is amongst the world’s highest-rated mobile banking app on Google Play Store, with a rating of 4.8, i.e., the highest across 59 global banks, 8 global NEO banks, and 50 Indian fintech apps.

We are leveraging our Axis Virtual Centre (AVC) channel for better lead conversion. Although digital has become the way of life post-pandemic, customers find themselves looking for differentiated brick-and-mortar experience. Hence, the hybrid journey of phygital is integral to deliver an enhanced customer experience. This model enables us to power all our interactions with customers and make a swift move between online and offline. Through our AVCs and virtual relationship managers, we provide an omnichannel reach to meet the demands of our customers.