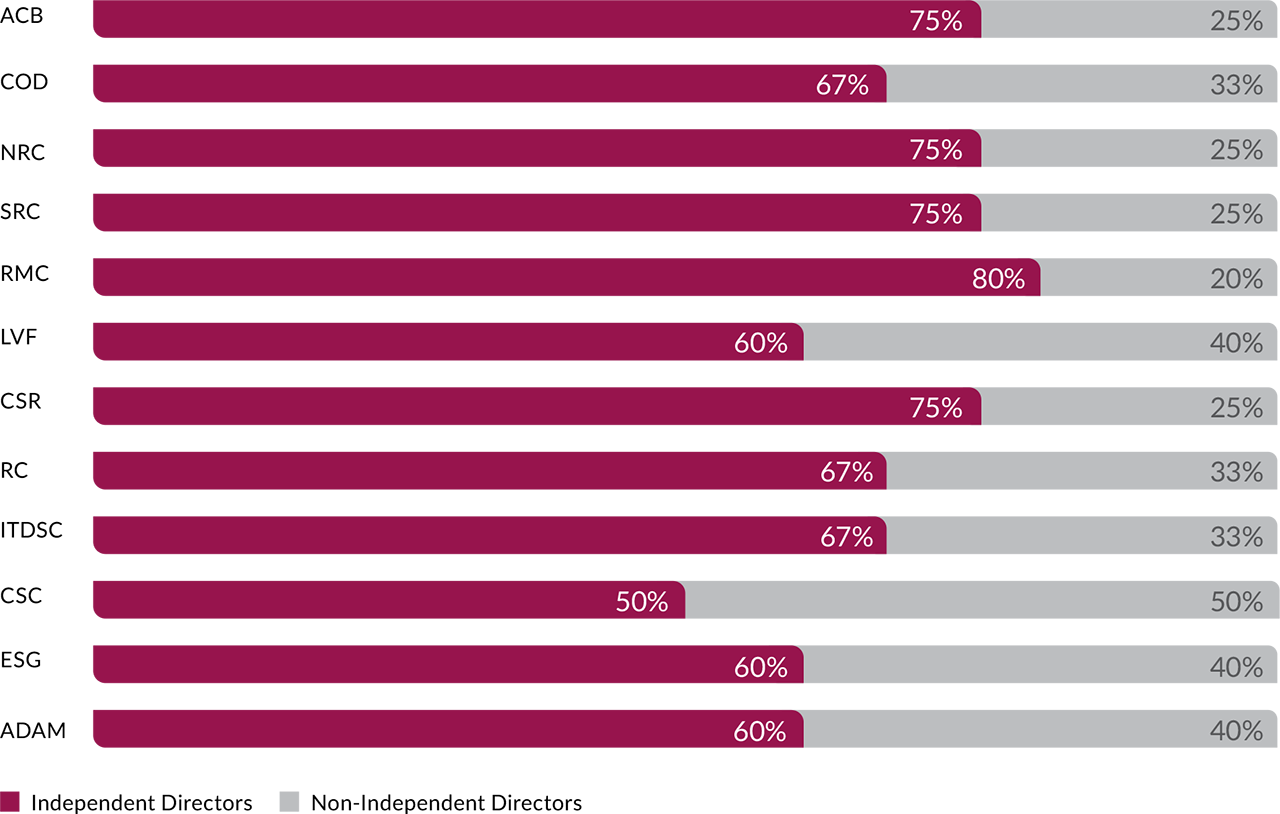

We ensure a high level of independence in the composition of our Board Committees.

We have taken proactive steps to develop a robust culture of compliance and ethics in the Bank. We have implemented polices and frameworks such as Anti-Bribery and Corruption Policy, Conflict-of-Interest Policy, Whistleblower Policy and Gifts Policy. We have focused programmes and training sessions covering areas such as Anti-Bribery, Anti-Corruption and Anti-Money Laundering to highlight our commitment to zero tolerance. Our Code of Conduct Policy and training programmes encourage employees to uphold values of customer centricity, team work, ownership, transparency and ethics.

Our Code of Conduct and Ethics Policy aims to improve the compliance culture within the organisation. The Code of Conduct and Ethics Policy outlines the accepted standards of behaviour for all employees at our Bank, ensuring that everyone takes the right course of action in their roles. During induction, all employees are expected to read and sign the policy document. Additionally, each year, employees have to read the Code and submit a declaration statement to HR confirming the same.

We have implemented a Conflict of Interest Policy which aims to identify, prevent and manage conflict of interest between employees and other stakeholders such as customers, vendors and business partners of the Bank. As a general rule, our employees are advised to avoid conducting Bank’s business with any relative of the employee. The employees are expected to act in the best interest of the Bank and refrain from engaging in transaction(s) where a conflict of interest exists and are also encouraged to report instances of conflict of interest that may become aware of.

We follow an open and transparent framework which encourages all stakeholders to report protected disclosures of any suspected or actual illegal, unethical or inappropriate actions, behaviours or practices without fear of retaliation or harassment of any kind. The Bank’s Whistleblower Committee can be contacted for an anonymous complaint which contains specific and verifiable information with respect to any such misdemeanours committed by any Bank personnel.

We have implemented a framework which makes employees liable for violations of Bank’s policies such as the Code of Conduct and Ethics Policy, Prevention and Sexual Harassment Policy, Conflict of Interest Policy, Anti-Bribery and Corruption Policy. The level of severity of the offence is determined by the respective Committees and penalties commensurate with the offence committed are levied on erring Bank personnel.

We have in place a holistic Information and Cybersecurity Programme, supported by the Information Security Policy, Cybersecurity Policy and standards based on industry best practices, with compliance to regulatory guidelines and in alignment to regulatory directives on information and cybersecurity.

No customer was affected due to any data breach. There are no fines/penalties paid in relation to information security breaches or other cybersecurity incident.

We have enhanced our customer privacy trust framework based on preparedness for emerging regulations such as the Data Protection Bill in India. Our Privacy Policy was updated in 2021 and includes key aspects of data privacy and security in our privacy framework.

We are dedicated to complying with internationally accepted human rights principles and standards, as well as implementing appropriate control measures to prevent any human right violations in our activities. We are guided by the Human Rights Policy framed with references from key global human rights frameworks and principles of the UN (United Nations), ILO (International Labor Organisation) and OECD (Organisation for Economic Cooperation and Development).