We remain focused on growing deposits, payments, advances and our subsidiaries to reach leadership positions across our businesses

CASA + Retail Term Deposit ratio CDAB*

Services offered through digital channels

Of our retail book is secured

Combined PAT of domestic operating subsidiaries

Bank and was the only domestic bank in the ‘Large Corporate (Institutional and Coverage Quality)' leader category at the 2021 Greenwich Excellence Awards

*Cumulative daily average balance

Above are standalone figures as on/for year ended 31 March, 2021 unless otherwise mentioned

We have enhanced non-credit revenue streams, driven leadership in costs, and embedded profitability in all business decisions

Share of Retail fee to total operating revenue of the Bank

Increase in Tech opex and capex spends in the last 24 months

People dedicated to digital agenda

Proactively increased capacity in the field and call centre collections teams to manage 2.5x volumes post moratorium

We have fortified credit risk management, built a strong compliance culture and strengthened the core through Technology, Operations and Process Excellence initiatives

High priority projects launched during the year

Risk management team size

Above are standalone figures as on/for year ended 31 March, 2021 unless otherwise mentioned

Despite adverse macro conditions, we reported healthy performance, which demonstrates the resilience of our operating model. This is the outcome of our rigorous execution of GPS strategy.

![]() y-o-y: Growth in fiscal 2020-21 vis-à-vis fiscal 2019-20

y-o-y: Growth in fiscal 2020-21 vis-à-vis fiscal 2019-20

Previous year figures have been re-grouped wherever necessary. All above figures are standalone

Each business of the Group is growing stronger and aspiring to be leaders in their domains. We are emerging as a formidable force under the ‘One Axis’ ecosystem. We follow an integrated approach with deep synergies, and are focusing on cross-selling our products and services through our subsidiaries.

Providing wholesale and retail lending solutions to corporate and retail customers, respectively across geographies and businesses.

One of India’s leading financial experts providing focused and customised solutions in the areas of investment banking and institutional equities.

Digital platform which connects MSME suppliers and corporate buyers to multiple financiers enabling sellers to sell their invoices to financiers, thus unlocking working capital quickly.

Providing ‘risk managed investment solutions’ and not just investment products to both retail and institutional investors.

An end-to-end broker, focusing on building an advisory model, with customer acquisitions for the fiscal 2020-21 period up 98% y-o-y to 315,417 customers organically.

Offering digital payments and digital financial service platform, which helps the Bank acquire young, digital native customers, through co‑created financial service offerings. It also creates a significant cross‑sell base for us.

SEBI registered debenture trustee; successfully handled various trusteeship activities (debenture trustee, security trustee, security agent, lenders’ agent, trustee for securitisation and escrow agent, among others).

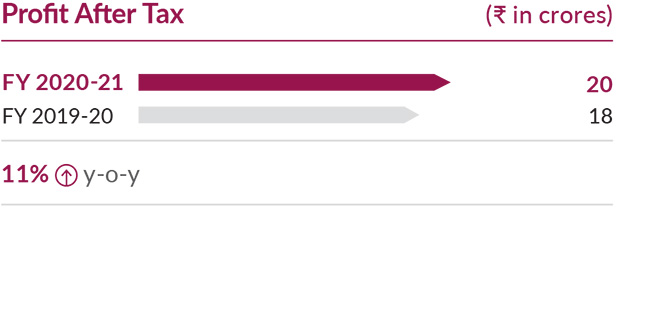

![]() y-o-y: Growth in fiscal 2020-21 vis-à-vis fiscal 2019-20

y-o-y: Growth in fiscal 2020-21 vis-à-vis fiscal 2019-20