Healthy CASA deposits growth, steady operating performance, resilient balance sheet

Healthy growth in granular CASA deposits continues to aid loan growth

Steady operating performance

Well capitalized with adequate liquidity buffers

Loan growth driven by all three business segments

Continue to maintain strong position in Digital

Balance sheet buffers strengthened with high PCR and additional provisions

Key subsidiaries delivered strong performance, Max Life stake acquisition complete

1. including profit for Q1FY22

QAB: Quarterly Average Balance

Coverage Ratio = Aggregate provisions (specific + standard + additional + Covid) / IRAC GNPA

Standard Assets Coverage Ratio (SACR) = Standard asset provisions plus additional provisions plus Covid provision / Standard loans

* Advances and deposits are after netting structured collateralised foreign currency loans. Further there has also been migration of certain loan accounts amongst segments in Q1FY22. Prior period numbers in the presentation have been regrouped as applicable for comparison.

Snapshot (As on June 30th, 2021) (in ` Crores)

| Profit & Loss | Absolute (in ` Crores) | YOY Growth |

|---|---|---|

| Q1FY22 | YOY growth | |

| Net Interest Income | 7,760 | 11% |

| Fee Income | 2,668 | 62% |

| Operating Expenses | 4,932 | 32% |

| Operating Profit | 6,416 | 10% |

| Net Profit | 2,160 | 94% |

| Balance Sheet | Absolute (in ` Crores) | YOY Growth |

|---|---|---|

| Q1FY22 | ||

| Total Assets1 | 10,12,050 | 14% |

| Net Advances1 | 6,14,874 | 12% |

| Total Deposits^1 | 7,13,862 | 16% |

| Shareholders' Funds | 1,03,890 | 21% |

^ period end balances

1. Advances and deposits are after netting structured collateralised foreign currency loans. Further there has also been migration of certain loan accounts amongst segments in Q1FY22. Prior period numbers in the presentation have been regrouped as applicable for comparison.

| Key Ratios | Absolute (in ` Crores) | |

|---|---|---|

| Q1FY22 | Q1FY21 | |

| Diluted EPS* (in `) | 28.19 | 15.79 |

| Book Value per share (in `) | 339 | 305 |

| ROA* | 0.86% | 0.48% |

| ROE* | 9.11% | 5.74% |

| Gross NPA Ratio | 3.85% | 4.72% |

| Net NPA Ratio | 1.20% | 1.23% |

| Basel III Tier I CAR** | 16.48% | 14.62% |

| Basel III Total CAR** | 19.01% | 17.47% |

* Annualised

** including profit for the quarter

11% YOY

11% YOY

12% YOY

12% YOY

13% YOY

13% YOY

94% YOY

94% YOY

Steady operating performance, net profit at `2,160 crores, up 94% YOY

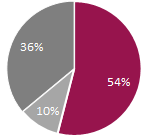

Loan book growth of 12% YOY driven by all three business segments

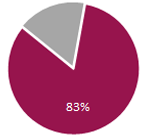

Healthy growth in stable and granular CASA deposits

Retain strong position in Digital Banking

Well capitalized with adequate liquidity buffers

Balance sheet buffers maintained, high PCR and additional provisions lend strength to the balance sheet

Bank's domestic subsidiaries deliver strong performance, annualized profit closer to ~ `1,000 crore

* Net Interest Margins

1 QAB – Quarterly Average Balance

2 LCR – Liquidity Coverage Ratio

3 Statutory Liquidity ratio

4 Figures of subsidiaries are as per Indian GAAP, as used for consolidated financial statements of the Group