Progress

Defined by Prudence

The value we create for our stakeholders is our prime indicator of success.

Financial parameters

Total Assets (` in crores)

14% 5 - year CAGR 19%  y-o-y

y-o-y

Total Advances (` in crores)

14% 5 - year CAGR 15%  y-o-y

y-o-y

Total Deposits (` in crores)

15% 5 - year CAGR 18%  y-o-y

y-o-y

Current Account and Savings Account (CASA)(` in crores)

12% 5 - year CAGR 16%  y-o-y

y-o-y

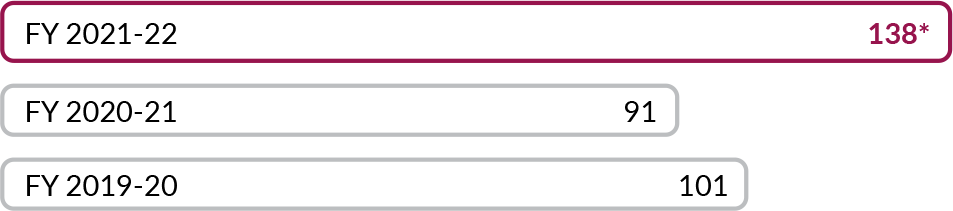

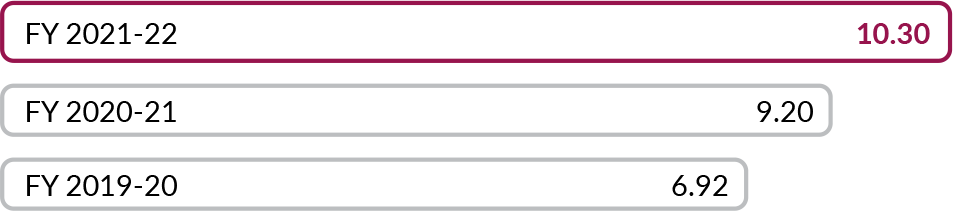

Net Interest Income (NII) and Net Interest Margin (NIM) (` in crores)

13% 5 - year CAGR 13%  y-o-y

y-o-y

Operating Revenue (`)

10% 5 - year CAGR 17%  y-o-y

y-o-y

Operating Profit (` in crores)

8% 5 - year CAGR 7%  y-o-y

y-o-y

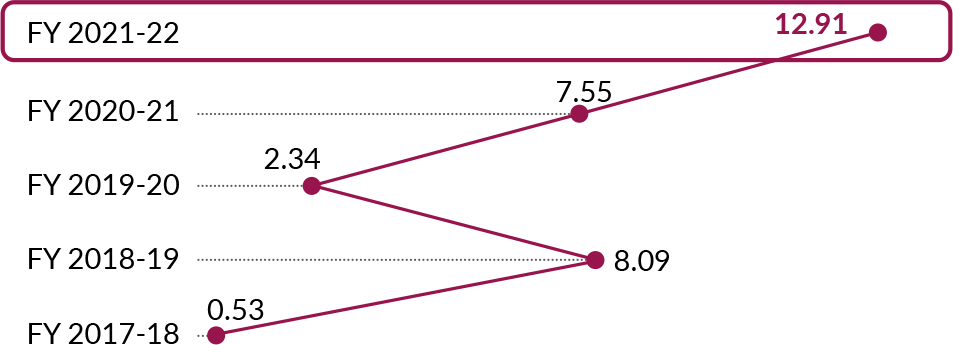

Net Profit (` in crores)

29% 5 - year CAGR 98%  y-o-y

y-o-y

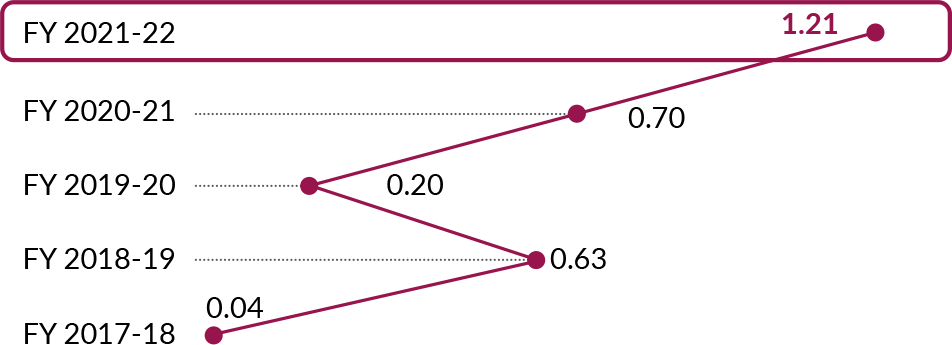

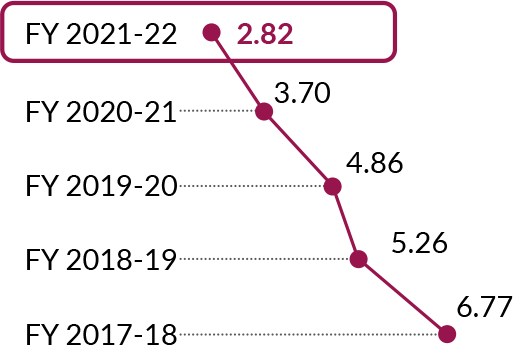

Earnings Per Share (Basic) (`)

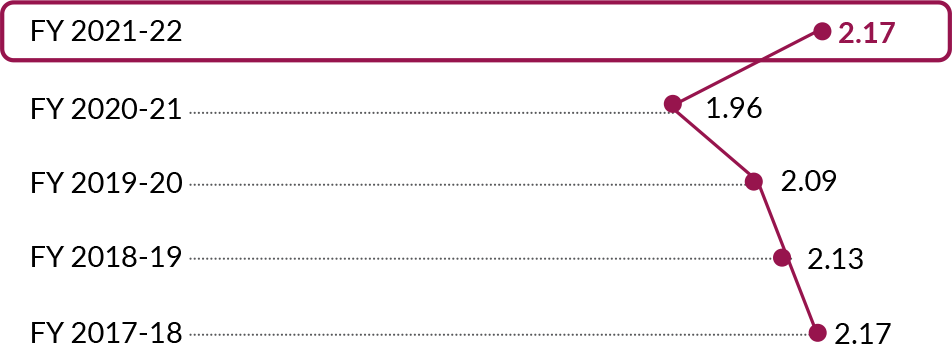

Book Value Per Share (`)

10% 5 - year CAGR 13%  y-o-y

y-o-y

Return on Equity (RoE)(%)

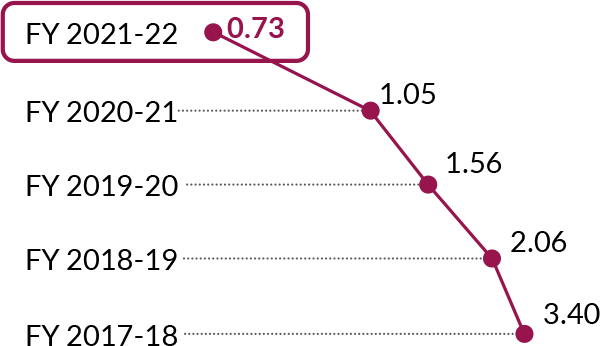

Return on Assets (RoA)(%)

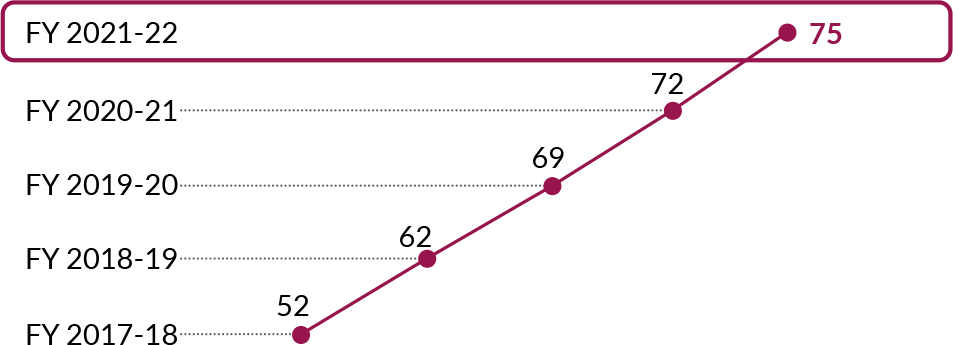

Provision coverage ratio(%)

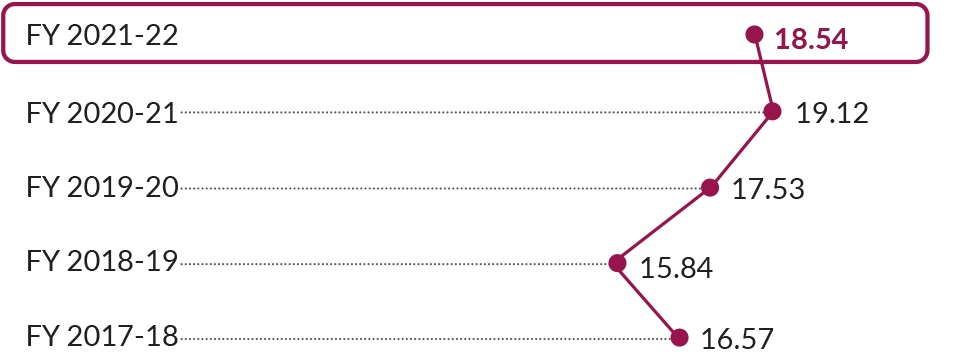

Capital Adequacy Ratio(%)

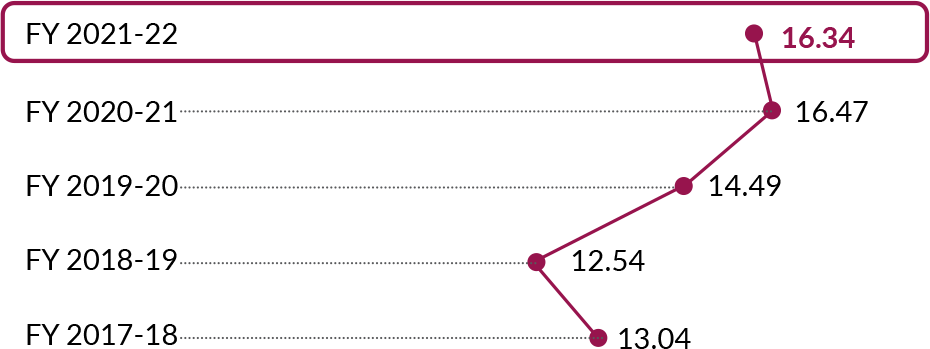

Tier-I Capital Adequacy Ratio(%)

Highlights of Subsidiaries*

44%

Growth in PAT of Domestic Subsidiaries

20%

Growth in Axis Capital PAT

47%

Growth in Axis AMC PAT

72%

Growth in Axis Finance PAT

40%

Growth in Axis Securities PAT

*y-o-y growth

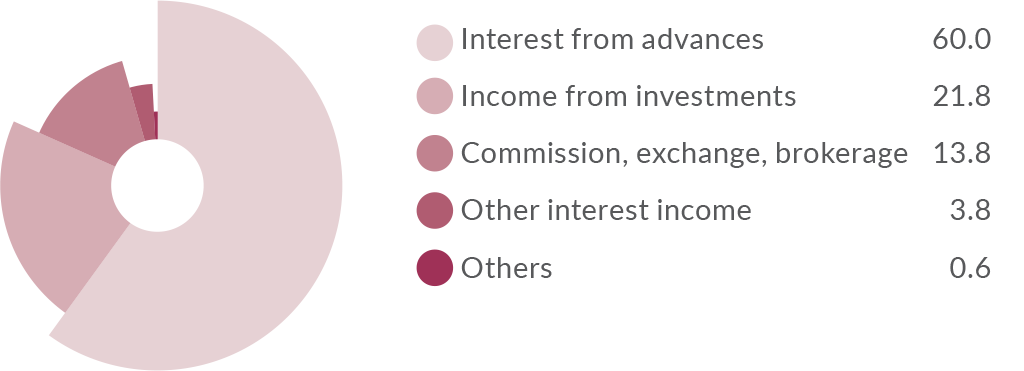

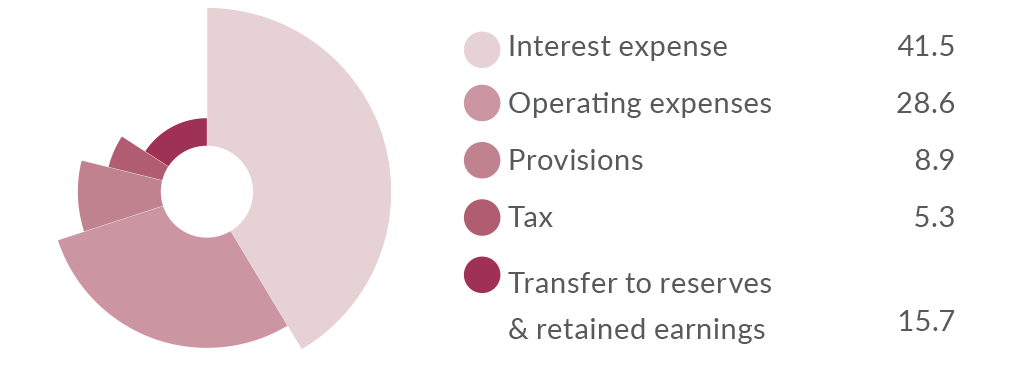

Rupee Earned and Rupee Spent (%)

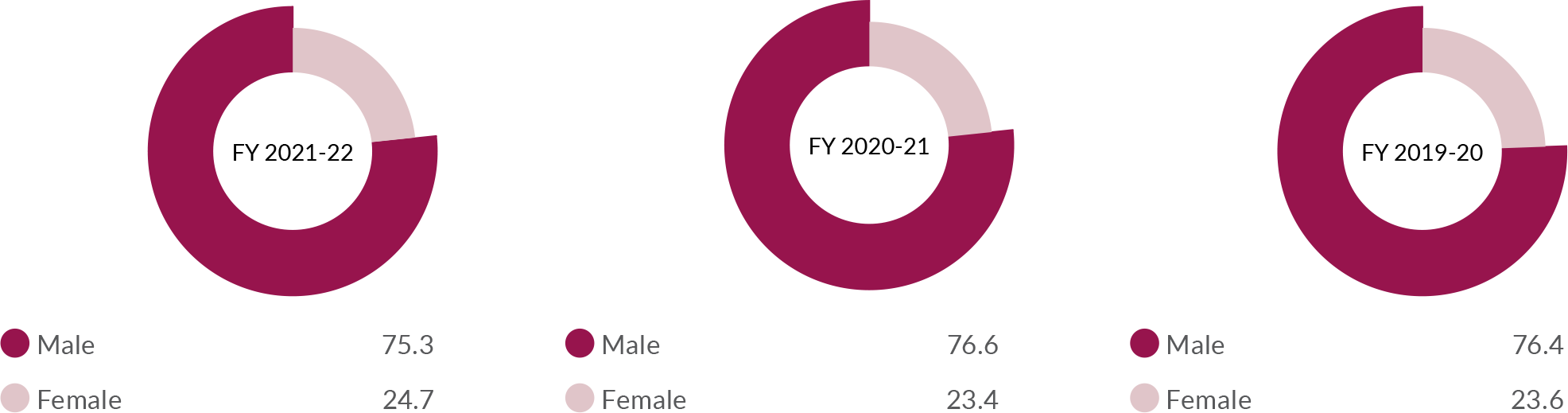

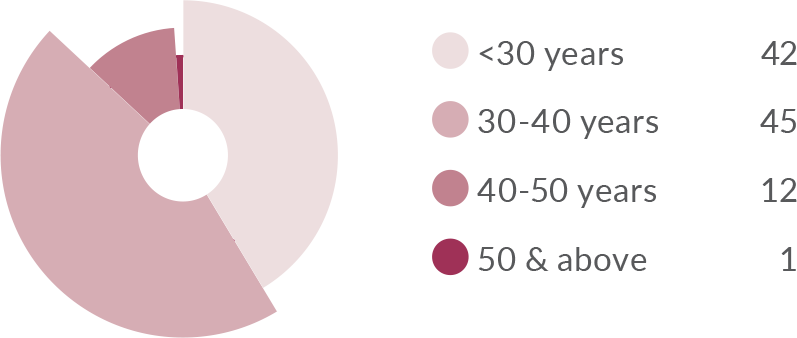

People

Average Person-hours of Training(%)

Community

Lives Impacted(No. in lakh)

Above are standalone figures as on/for year ended 31 March, 2022 unless otherwise mentioned

* including amount transferred to unspent CSR account `24.68 crores to be utilised towards ongoing projects/programmes