Digital

Our consumers can now conduct a host of their banking transactions digitally. Our digital banking follows our OPEN philosophy into every stage of the consumer lifecycle ─ from onboarding and transacting to servicing, underwriting and collections.

Leveraging high-end data analytics and optimising omnichannel experiences helps us preserve and strengthen our consumer connect. Our wide array of digital-first products reinforces hyper-personalisation and offers a simplified end-to-end journey to deliver a satisfying consumer experience.

Savings accounts sourced through tab banking*

Fixed deposits opened digitally

Video KYC enabled savings account**

* Digital tablet-based account opening process in fiscal 2022

** Non-salaried savings account

Personal loans disbursed digitally

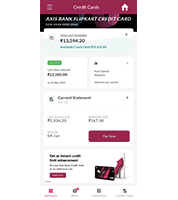

Credit cards issued digitally

Credit cards – digital EMI conversion

New Mutual Fund SIP sales

New public provident fund accounts digitally acquired

Offering additional discounts to our consumers who like to shop online with our partners ─ Amazon and Flipkart.

Helping small merchants grow their businesses through timely cash infusion.

Reducing the hassle and time for consumers to get multi-currency forex cards for diverse needs.

Swift auto loans for consumers by doing away with physical documents.

Providing digital loans to consumers ‘right there, right now’.

Providing instant credit to consumers to manage their cash requirement.

We are building resilience by adopting the latest in technological advances, to achieve the highest standards of data security and privacy for our consumers. We are focused on developing our in-house tech, design, and AI capabilities guided by a sustainable governance structure.

Amongst the lowest UPI transaction failures

Customer facing application on cloud platform