Business

Segment Performance

Through our subsidiaries, we bring to the table a plethora of services for our consumers under the 'One Axis' umbrella.

Axis Capital is one of India's leading financial experts providing customised solutions in the area of investment banking and institutional equities.

Axis Capital completed 44 ECM transactions in fiscal 2022, including 27 IPOs, 8 QIPs, 2 OFS and 2 Rights issue. It maintained its leadership position in the ECM by working with companies across multiple sectors to raise equity. Marquee transactions included first ever InvIT by a PSU, the largest ever public InvIT transaction, along with the largest ever hospital IPO.

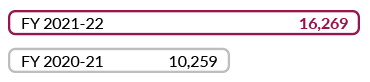

Rank in Equity Capital Market (ECM)

Growth in Equity business trading volume in cash segment

Growth in Equity business trading volume in F&O segment

y-o-y growth in PAT to `200 crores

*Source: Prime database, March 2022

Through Axis Finance, we provide wholesale and retail lending solutions to corporate and retail consumers respectively, across geographies and businesses. We leverage our ‘One Axis’ capabilities to expedite operations. It is an ‘AAA’ rated diversified NBFC, with strong operational and risk management backed by robust technology. It has consistently delivered best in class operating metrics and return ratios.

y-o-y growth in Retail loan book

y-o-y growth

in Wholesale

loan book

with 91% of

secured loans

Return on Equity

y-o-y growth in PAT to ` 364 crores

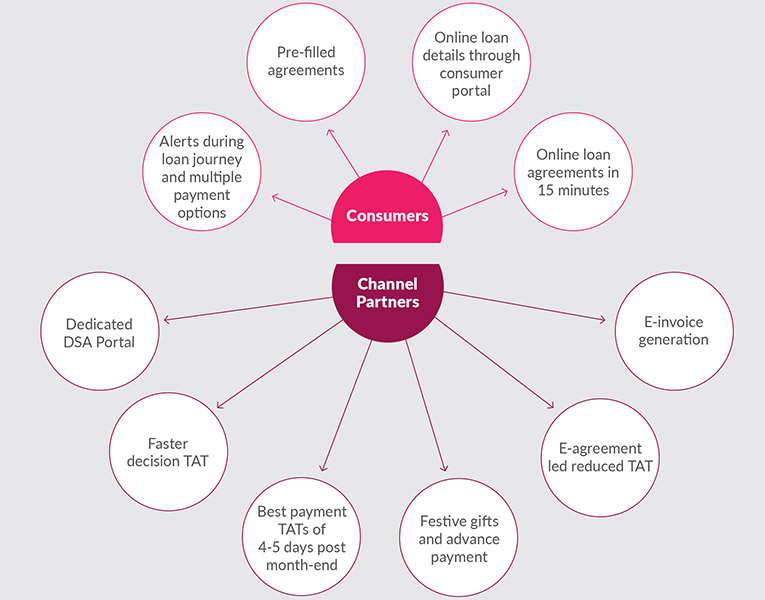

During fiscal 2022, we took several initiatives for our consumers and channel partners

Axis Asset Management Company Ltd.

Axis Asset Management Company Ltd.

Axis Asset Management Company (AMC) provides risk managed investment solutions to both retail and institutional investors.

43% 3-year CAGR

43% 3-year CAGR

48% 3-year CAGR

48% 3-year CAGR

Incremental Average AUM market share y-o-y led by fund performance

Equity AUM growth in last 12 months, maintaining itself as one of the fastest growing AMC in the country

y-o-y growth in client folios that stood at 12.8 million as at 31 March 2022

y-o-y growth in PAT to ` 357 crores

Seamless Investing Experience for Everyone

Transact from Anywhere, Anytime

Investors can invest in Axis Mutual Fund’s schemes via our website, mobile app, through exchanges, Registered Investment Advisors, Mutual Fund Distributors, as well as Fintech Players

Invest in Just One Minute

Our B2C App and website have successfully reduced the time taken to invest in a Mutual Fund Scheme, which earlier took about 30 minutes in an offline world, can now happen in just one Minute

Convenient and Safe Investments

We have also enabled the option to invest via UPI or Net- Banking

Creating Sustainable Value

Customised Investment Packs

A hand-picked solution that allows investors to select an optimal blend of schemes, designed to help them achieve their financial goals

Gamut of Investment Products

Investors can browse through our selection of investment products and identify the scheme they find suitable

Axis Securities is an end-to-end broker, focused on building an advisory model to acquire consumers. We have deployed continuous enhancements in the technology front to deliver class-leading experiences to our consumers. During fiscal 2022, we have launched the pre-IPO order facility and our and brought forth upgraded offerings on our mobile app.

of clients traded through Axis Direct Mobile App

y-o-y growth in PAT to `232 crores

Share of mobile trading in total volume

26% 3-year CAGR

26% 3-year CAGR

Building a Future of Possibilities with Automated Investing

The future of possibilities is here with our key focus being digital transformation, backed by cloud hosting, Artificial Intelligence and Machine Learning. We envisage automated investing driven by Artificial Intelligence and high level of personalisation for the Burgundy and Burgundy Private segments, supported by the expansion of Private Client Group branches and Advisory personnel base.

These initiatives will enable us to scale, focusing our vision for building value and empowering consumers to access the world of possibilities, effortlessly.

Axis Trustee Services is registered with the SEBI and has been successfully executing various trusteeship activities including debenture trustee, security trustee, security agent, lenders’ agent, trustee for securitisation and escrow agent, among others.

Invoicemart is a digital invoice discounting, Trade Receivables Discounting System (TReDS) platform, that empowers MSMEs by making working capital easily accessible, while also tackling delayed payments. The platform aids in price discovery for MSMEs across 580+ cities and 2,500+ pin codes in India, enabling bill discounting from financiers including Banks and NBFC Factors, over the App. Invoicemart is the 1st platform to facilitate financing of MSME invoices of more than $3 billion through the online platform. Invoicemart is India’s largest TReDS platform that promises to revolutionise the way businesses get paid.

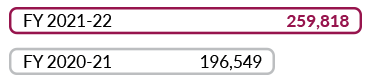

Throughput

Invoices discounted

Participants on-board

Freecharge has launched multiple new age products targeted towards digitally native consumers and merchants. It continues to evolve into a complete digital financial services platform, covering all aspects like Savings, Lending, Investments, Payments and insurance.

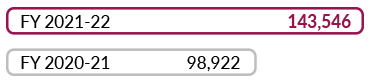

Gross Merchandising Value (GMV)

y-o-y growth in GMV

Transactions

Transactions by Paylater Customers

Monthly Unique Active Customers

Freecharge has been certified as a great workplace by ‘Great Place to Work Institute’ to attract the best talent for exploring new possibilities to come up with last mile banking solutions.

Freecharge Pay Later

A monthly interest free credit limit with instant digital onboarding

Merchant Cash Advance

An integrated product targeting SMEs, providing loans between ₹ 3,000 and ₹ 1 lakh with a unique daily instalment repayment methodology

Freecharge PL+

A ticket lending product designed to meet short term capital needs of consumers using real-time underwriting and eKYC

Neo Banking – Offering a World of Possibilities for Managing Individual Financial Health

Freecharge‘s upcoming Neo Bank offers a world of possibilities to consumers to achieve their financial goals. With a fully digital savings account, consumers will have access to: